- January 11, 2023

- admin

- 0

By Freddie Avila

Exploring Solar Panel Purchase Options: Top 10 Ways

Empower Your Home with Solar Savings

Discover the best 10 ways to acquire solar panels with informed decisions and cost savings!

1. Cash Purchase

Opt for a cash purchase for solar panels – a savvy choice with no interest, loan fees, or credit score concerns. The long-term savings make it a wise investment. Cash purchases are particularly appealing if you have the financial capacity upfront. Keep in mind that solar panels have a long lifespan, ensuring that your savings accumulate over time.

2. Loan Financing

Embrace solar power with loans tailor-made for solar panels. Find suitable financing options, keeping in mind that credit scores may influence choices. Loans offer flexibility, allowing you to start benefiting from solar energy while paying in manageable installments. Compare interest rates and terms to choose the most cost-effective loan.

3. Credit Union Loan

Navigate solar panel loans smoothly with local credit unions. Enjoy lower fees, higher savings rates, and personalized service, along with a voice in credit union policies. Credit unions often prioritize their members’ well-being, making them a fantastic resource for finding competitive loan rates and supportive financial guidance.

4. Property Assessed Clean Energy (PACE) Loans

Government-approved loans, working alongside private lenders, make financing solar panels manageable through property tax bill increments. PACE loans are an innovative way to finance energy-efficient upgrades, including solar panels, without an immediate financial burden. It’s crucial to understand the terms and conditions, including the repayment structure and potential impacts on property taxes.

5. Home Equity Loan

Elevate energy efficiency with solar panels via a home equity loan. Borrow up to 80% of your home’s equity for upfront solar investment, benefiting from lower energy bills and increased property value. Home equity loans provide a lump sum that you can invest in your solar project, making it a strategic way to enhance both your home’s value and your quality of life.

6. Home Equity Line of Credit (HELOC)

Tap into a HELOC for solar panels – a flexible revolving line of credit secured by your home. While it provides pay-as-you-go convenience, be mindful of interest payments over time. A HELOC can serve as a financial safety net for solar panel projects and other home improvements. Be sure to carefully manage your payments to avoid higher interest costs in the long run.

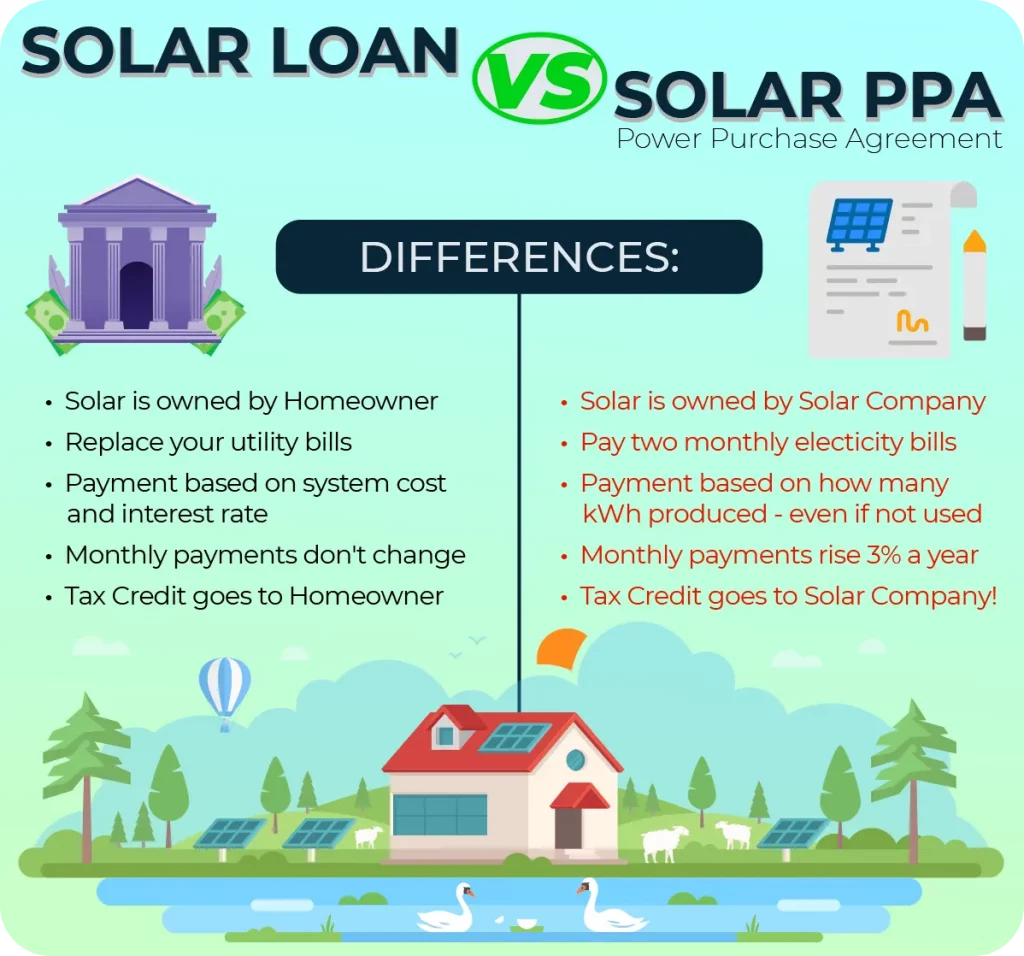

7. Solar Lease or Power Purchase Agreement (PPA) – Exercise Caution

Approach solar leases or PPAs cautiously, as they might not be as beneficial as they appear. Beware of escalator clauses, aggressive sales tactics, and the potential for missed payments leading to repossessions. Leasing solar panels might provide upfront cost savings, but it could also tie you into long-term contracts with potential downsides, such as rising energy costs and limited financial benefits.

8. Interest-Free Credit Card – Highly Recommended

Use a 0% interest credit card to finance solar panels over a specific period. Pay attention to the repayment period and set up automatic payments for simplicity. Interest-free credit cards can be a fantastic tool for short-term financing, allowing you to spread out the cost of solar panels without incurring additional interest charges. However, be diligent in repaying the balance within the interest-free period.

9. VA Emergency Efficient Mortgage (EEM)

Veterans can consider the EEM program to finance solar panels and enhance energy efficiency. Benefit from reduced utility bills and improved resale value. The EEM program enables eligible veterans to finance energy-efficient improvements, including solar panels, through their VA-insured mortgage. This program aligns with veterans’ goals of efficient, eco-friendly living while also increasing property value.

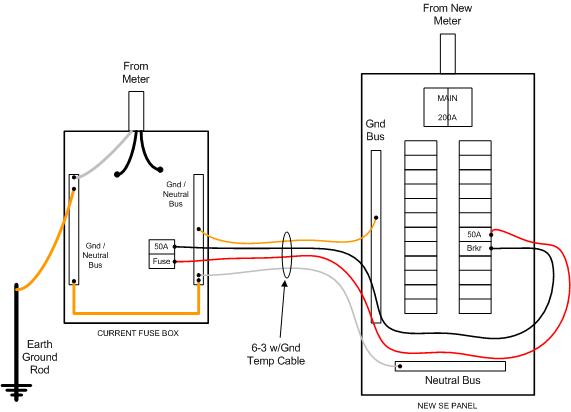

10. Refinancing Your Home

Refinancing your home to include solar panels is a smart move. Combine this with paying off existing loans and discuss solar panel presence with your lender for the best outcome. Refinancing allows you to optimize your mortgage terms while incorporating solar panels into the overall financial strategy for your home. Carefully evaluate the potential benefits and costs associated with refinancing before making a decision.

BONUS: Energy Efficient Mortgage (EEM) by FHA

FHA’s EEM program supports energy-efficient improvements through FHA-insured mortgages, reducing utility bills and promoting affordability. The EEM program offers an avenue for homeowners to finance energy-efficient upgrades, including solar panels, through their FHA-insured mortgage. This program not only contributes to reduced utility expenses but also enhances the overall affordability of homeownership.

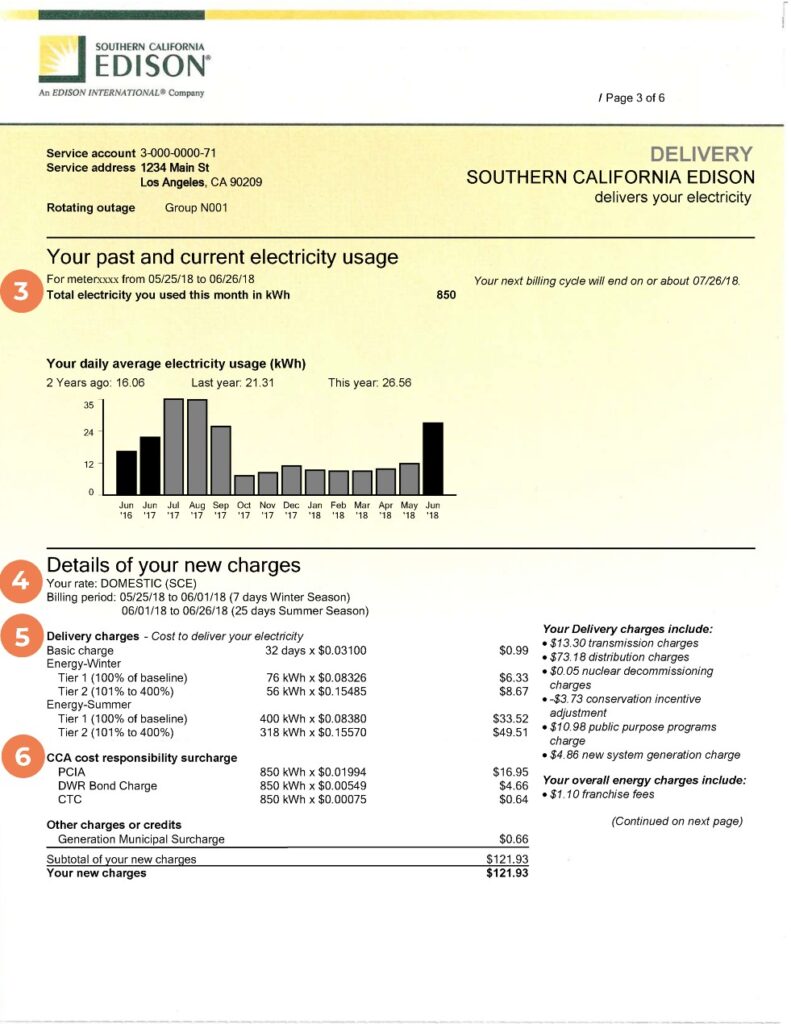

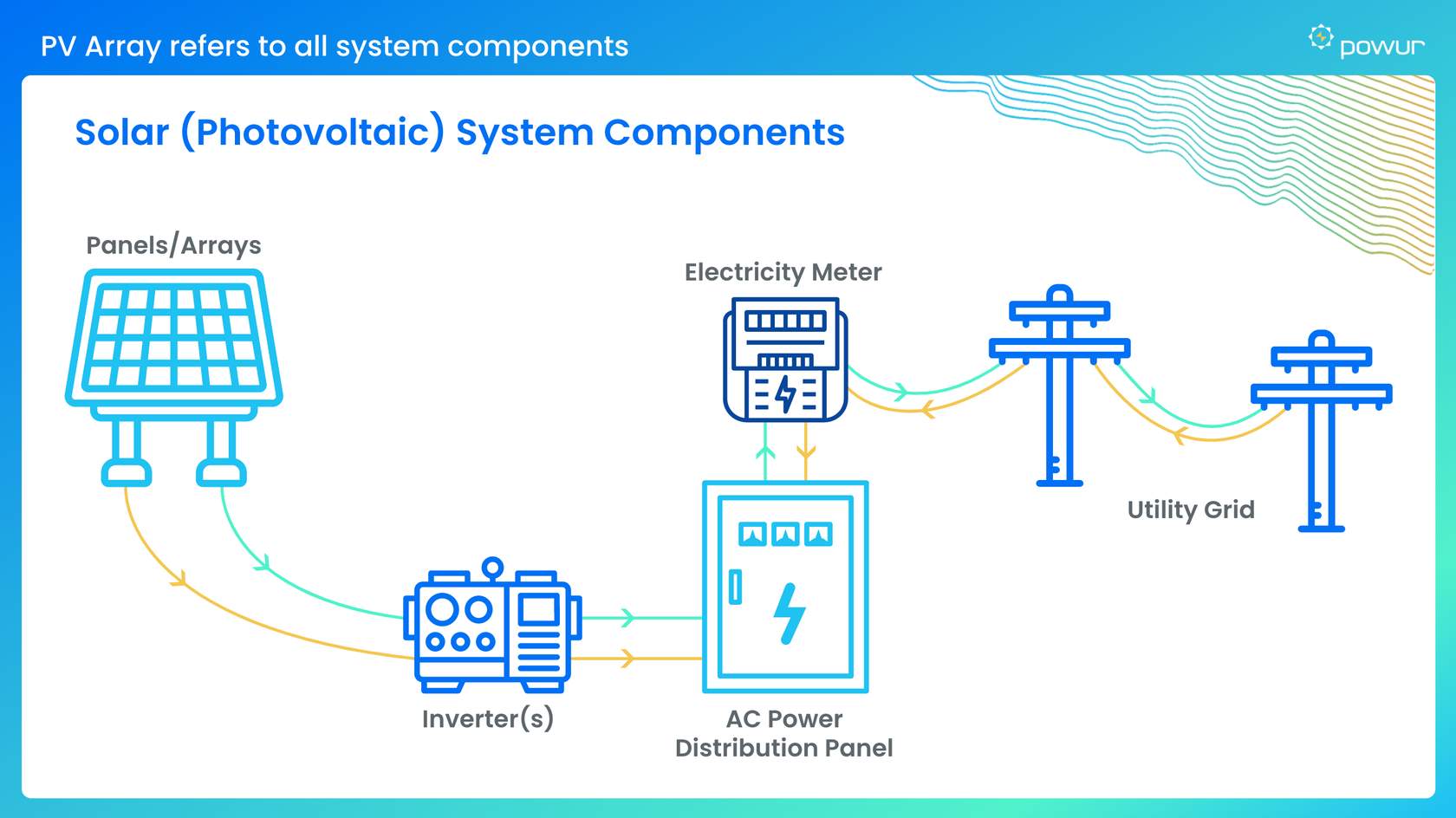

Boosting Property Value with Solar Panels

Every dollar saved on electricity through solar power enhances property value by $20, according to the National Renewable Energy Laboratory. Homes with solar panels sell for about 4% higher, as per Zillow. Solar panels offer not just energy savings but also increased home value! The financial benefits of solar panels extend beyond energy bill savings, positively impacting your property’s worth.

Stay Informed and Join the Conversation

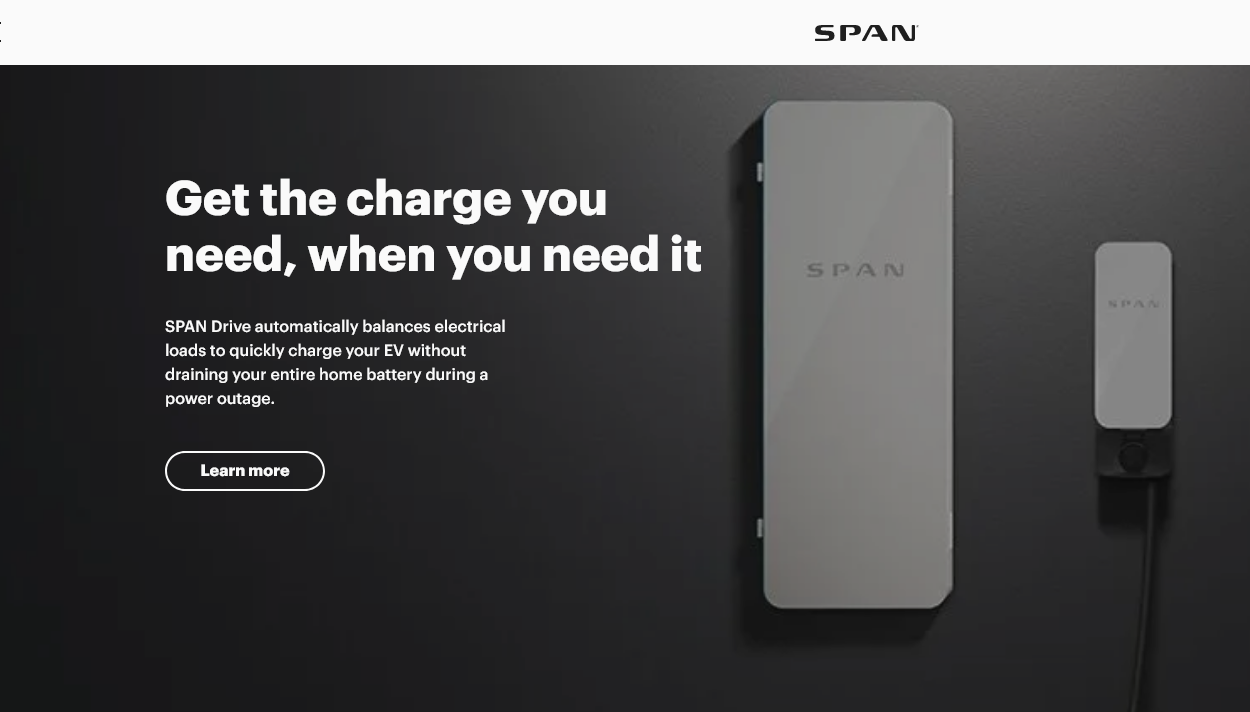

Stay updated with the Utility Resource Guide app and join Home Solar Simplified on Nexdoor for future developments. These resources can help you stay informed about solar industry trends, financing options, and opportunities to engage with like-minded individuals interested in solar energy and sustainable living.

Invest in solar – a smart choice for both your wallet and the environment!

- Cost-Effective Test for Existing Homes

- Cost-Effective Test for Newly Constructed Homes

- Building Performance Institute Building Analyst Professional

- Building Performance Institute Home Energy Professional Energy Auditor

- Residential Energy Services Network Home Energy Rater; or

- energy rater, assessor, or auditor who meets local or state jurisdictional requirements for conducting residential energy audits or assessments, including training, certification, licensure, and insurance requirements.

- the Adjusted Value;

- 115 percent of the median area price of a Single Family dwelling; or

- 150 percent of the national conforming mortgage limit.

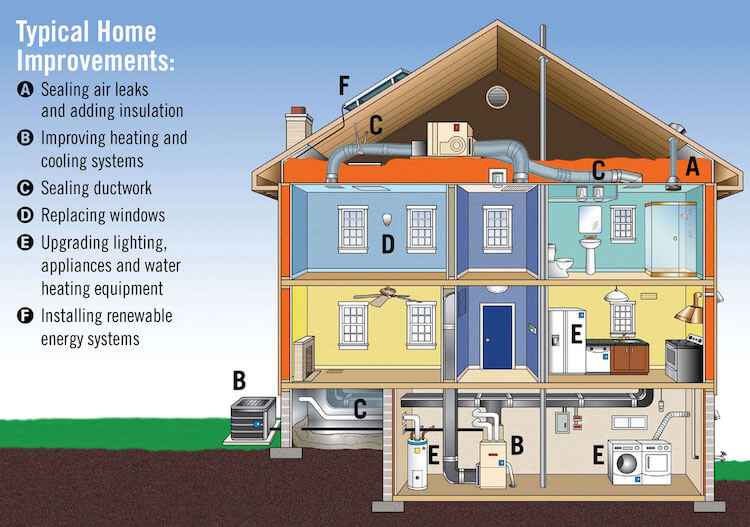

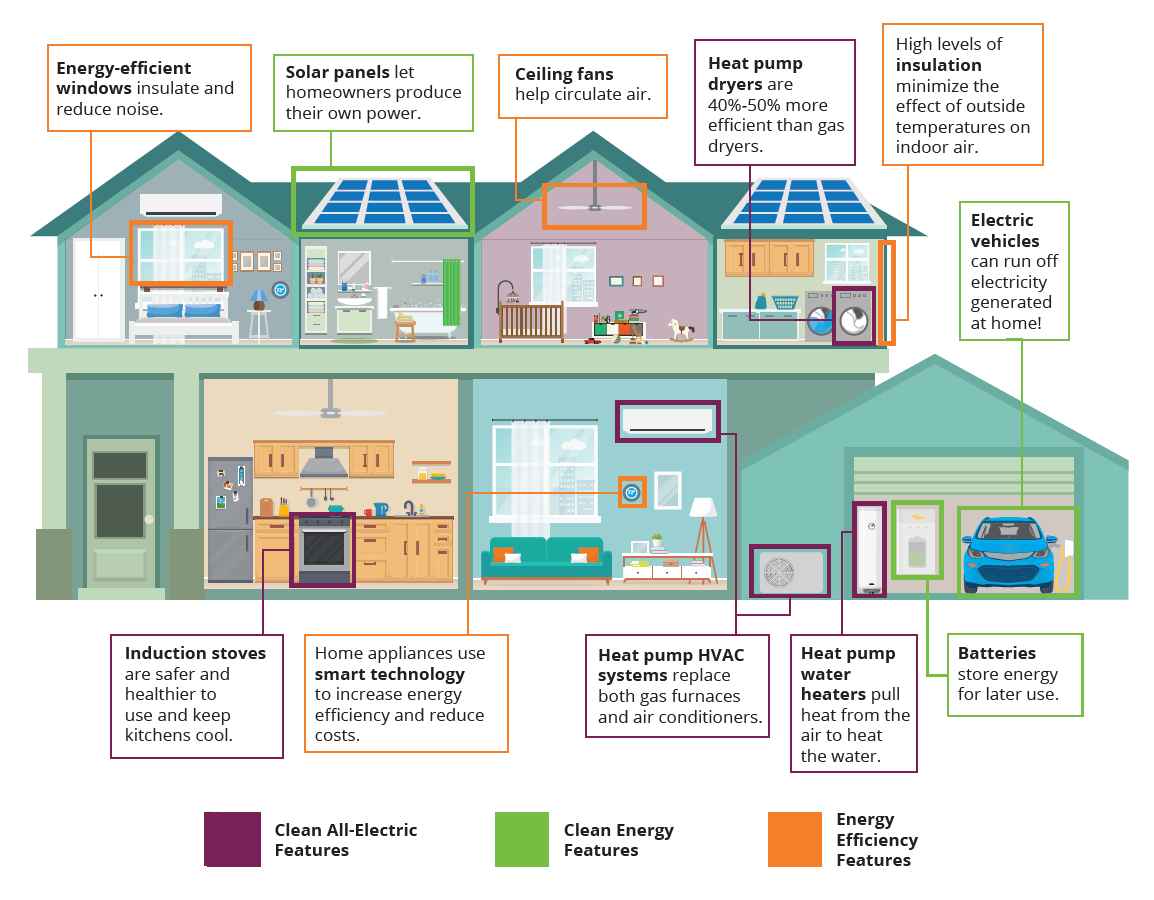

- Energy Efficient Homes (EEH)

- Solar and Wind Technologies

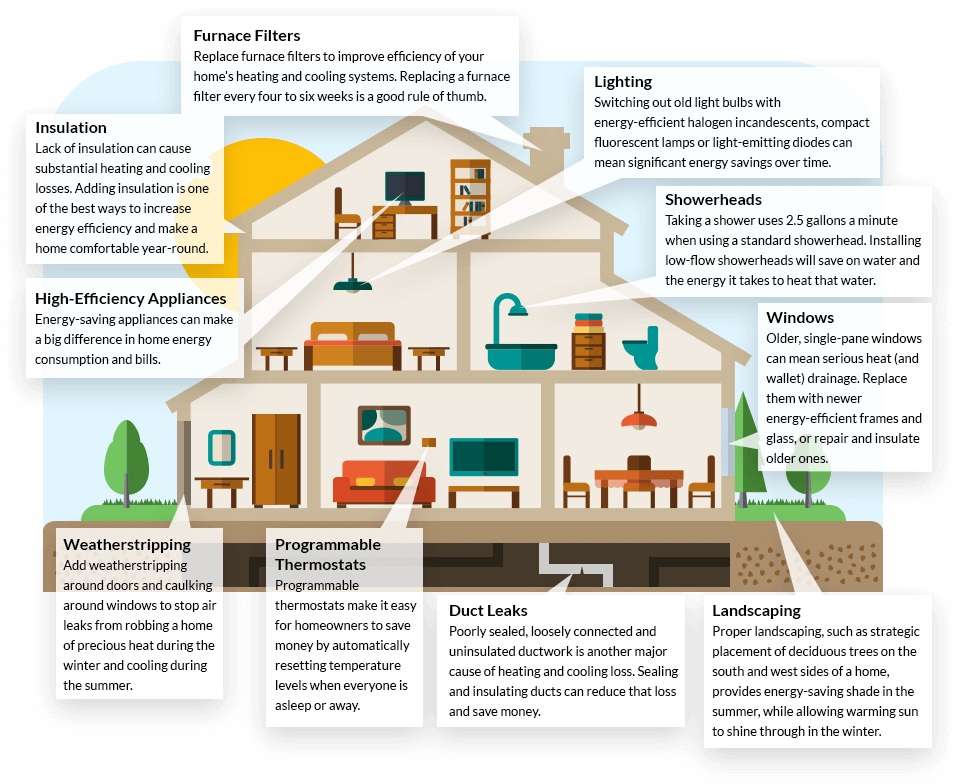

- Weatherization