- February 9, 2023

- admin

- 0

The Energy Efficient Mortgage (EEM) program, initiated by the Department of Housing and Urban Development, helps families finance energy-efficient improvements through their FHA-insured mortgage. The program was first introduced as a pilot demonstration in five states in 1992 and expanded nationwide in 1995.

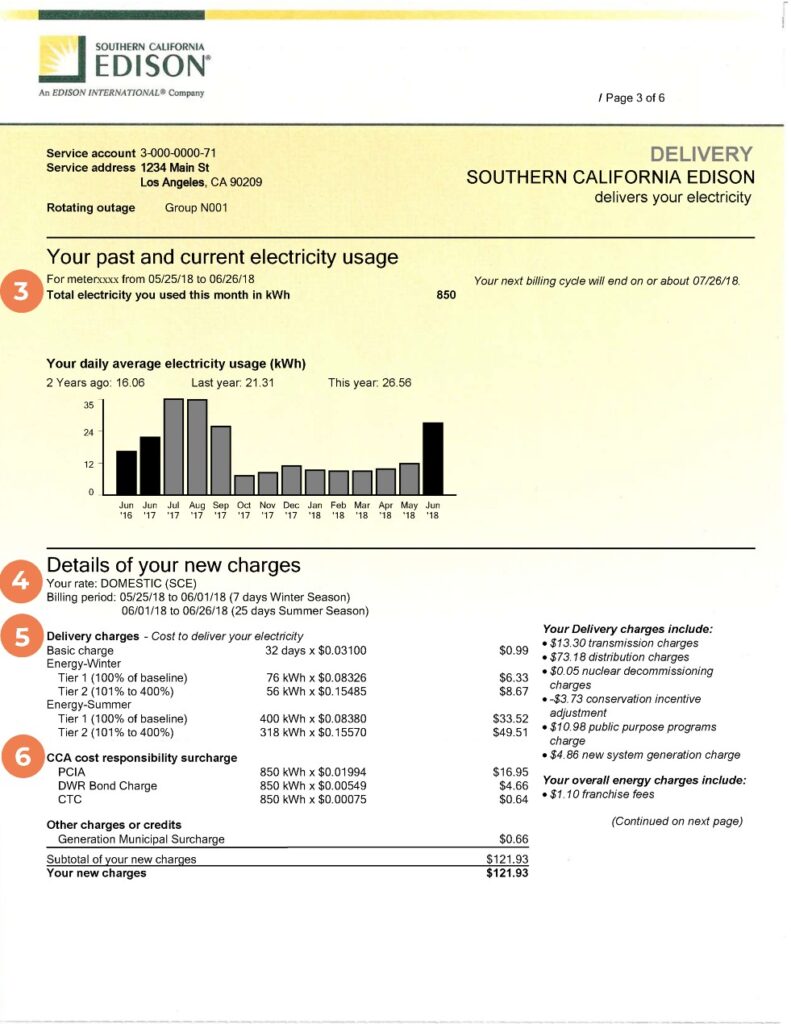

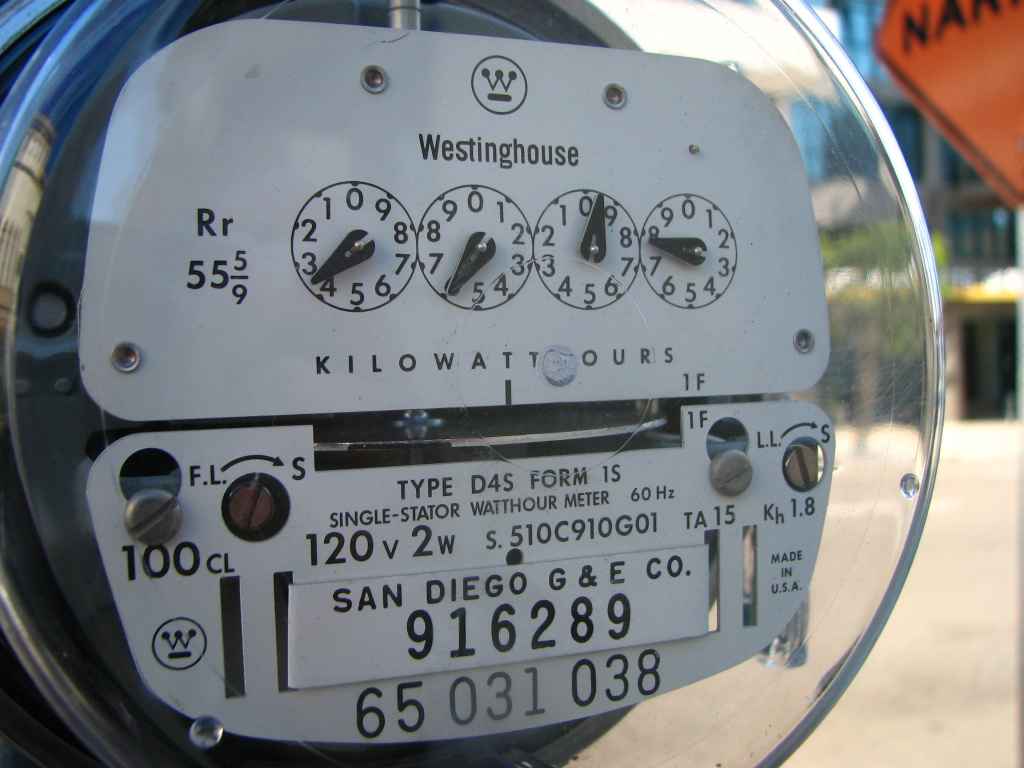

Under the EEM program, homeowners can finance qualified energy-efficient improvements alongside their home purchase or refinance. The program recognizes that reduced utility expenses can free up additional income, making it more affordable for homeowners to pay a higher mortgage that covers the cost of energy improvements.

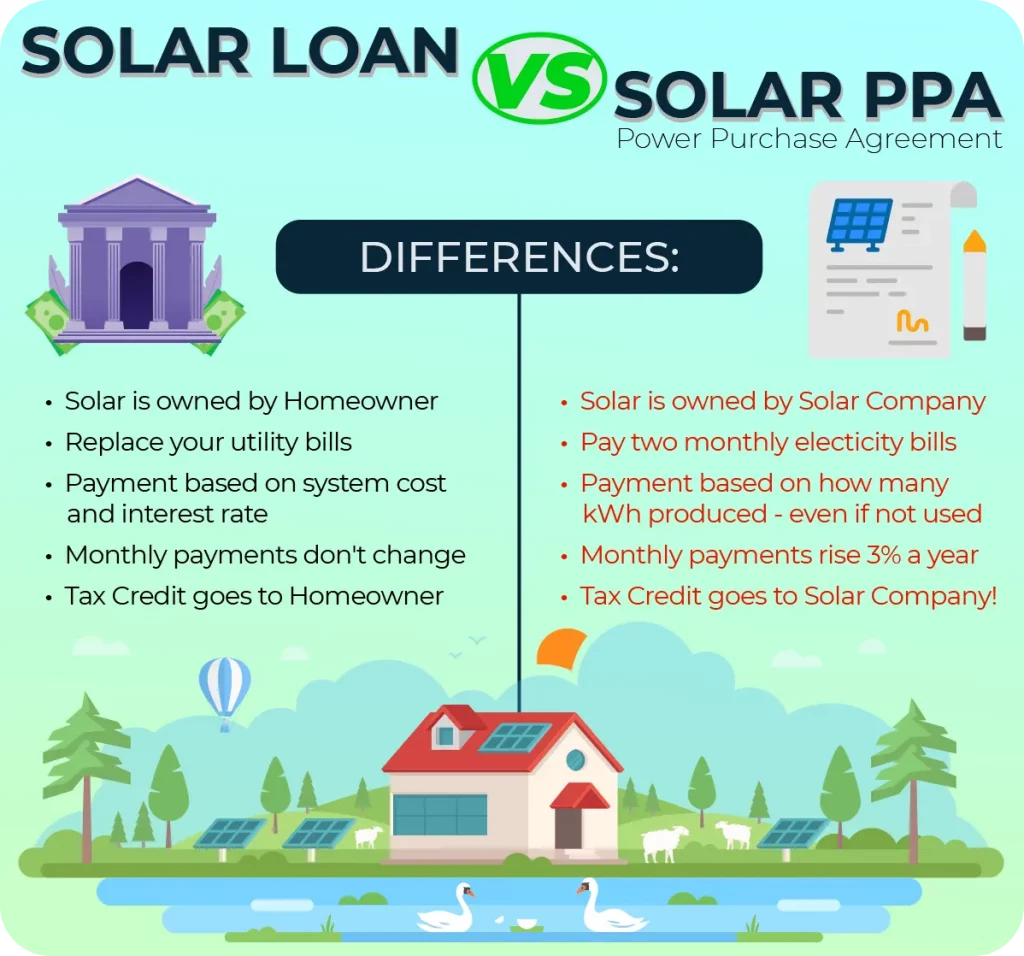

To participate in the EEM program, borrowers need to qualify for the loan amount used to purchase or refinance the home, rather than the total loan amount with the portion dedicated to energy-efficient improvements. The loan is processed, approved, and funded by a lending institution, such as a mortgage company or bank, with FHA providing insurance to protect the lender against default.

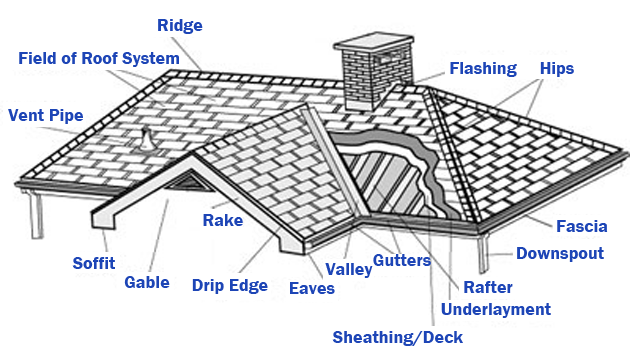

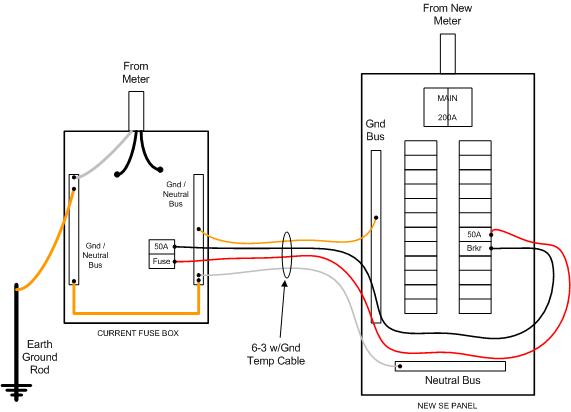

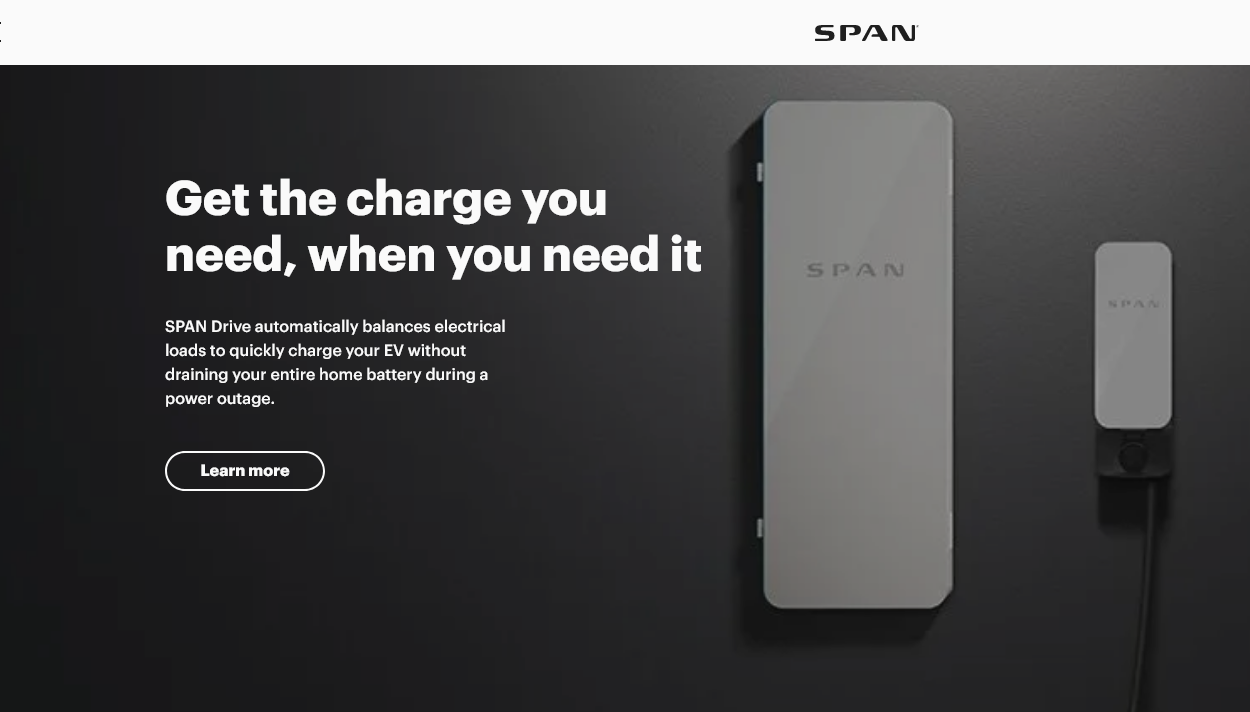

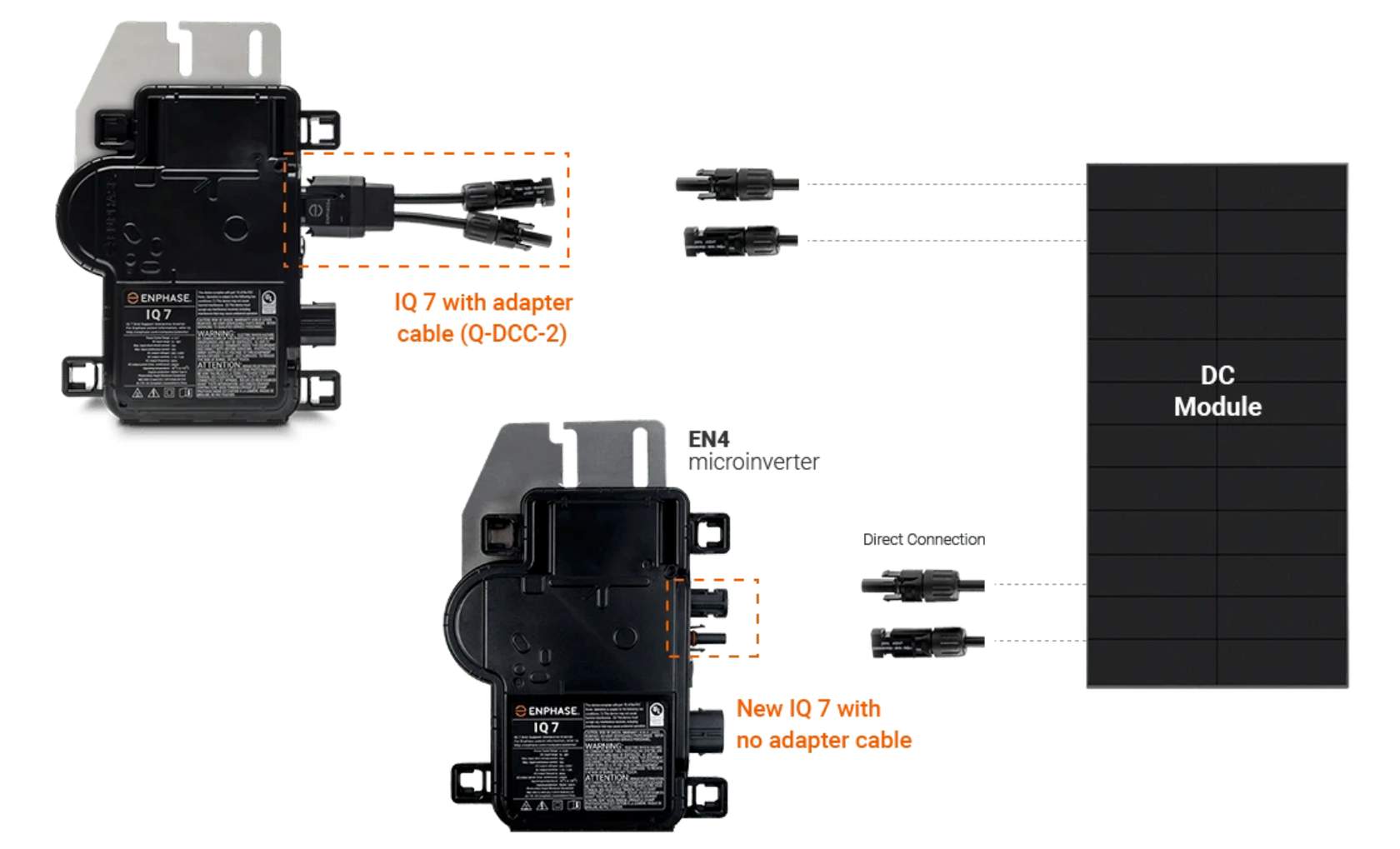

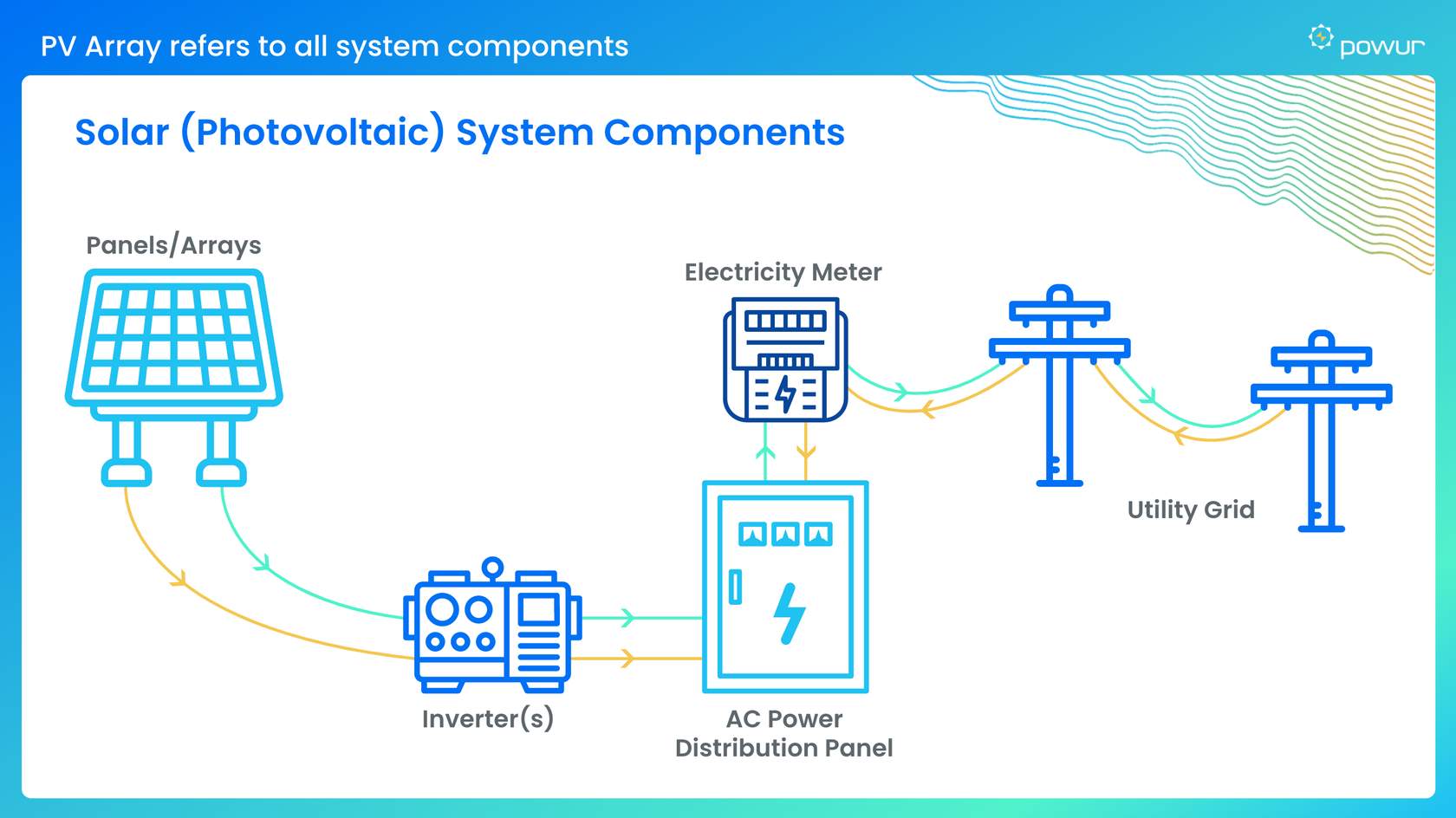

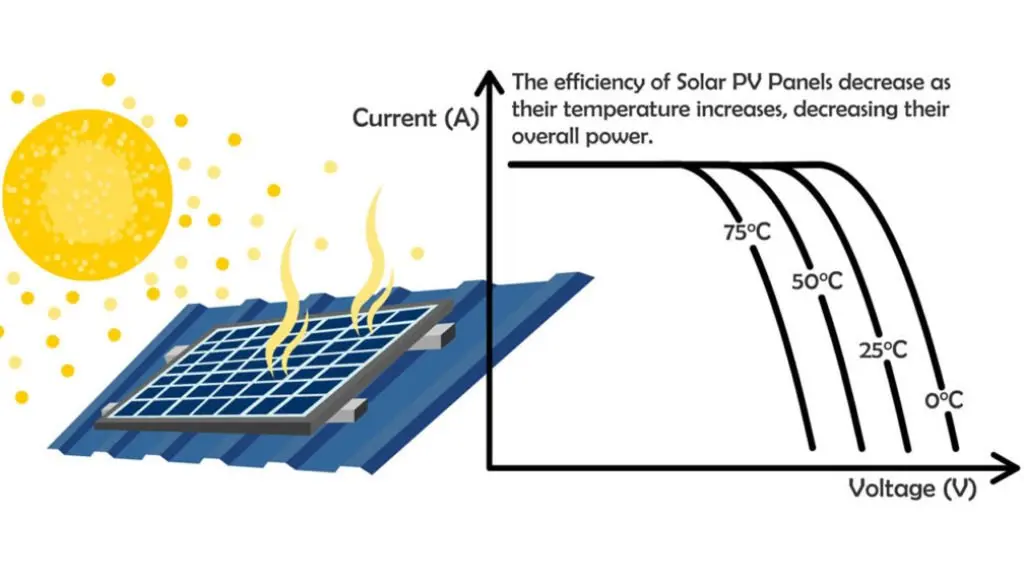

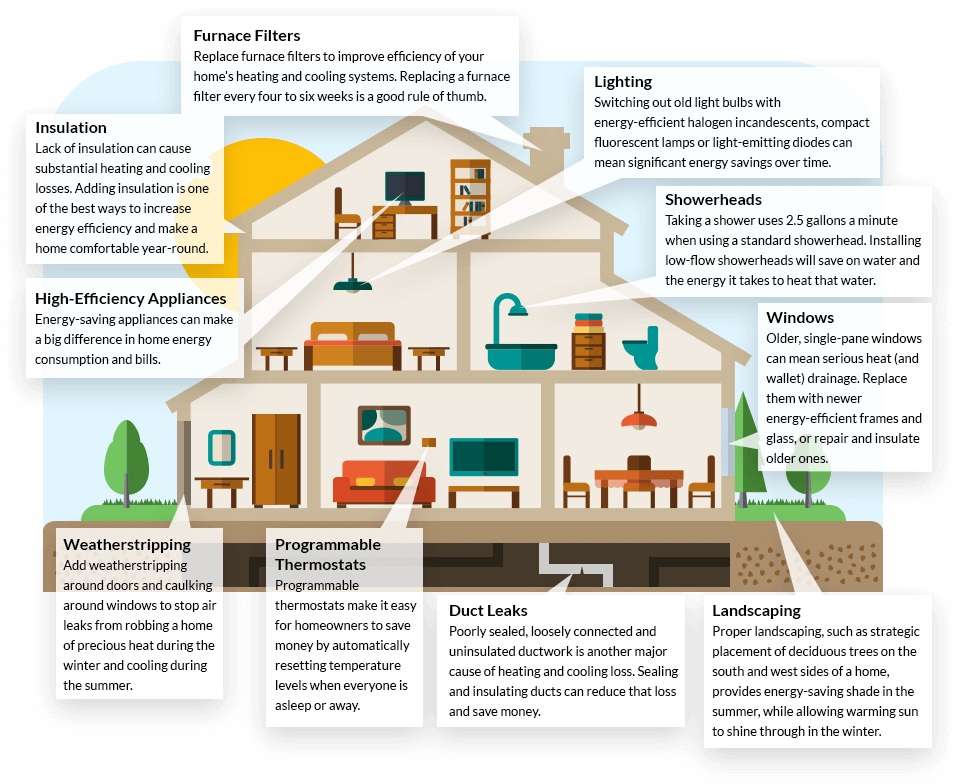

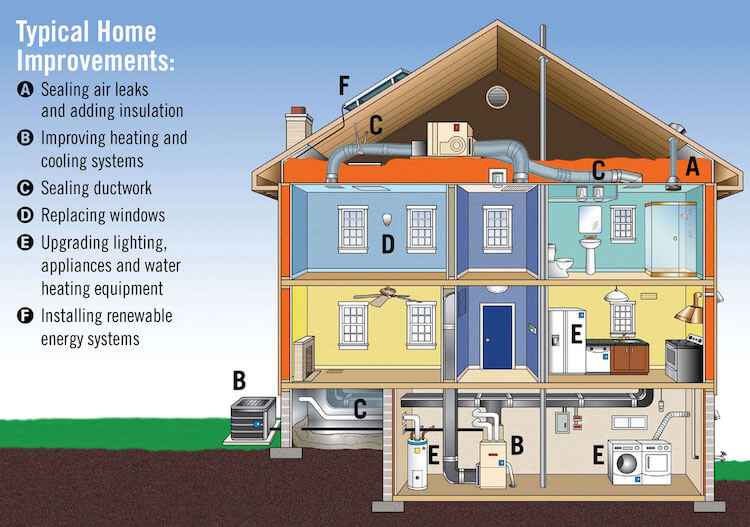

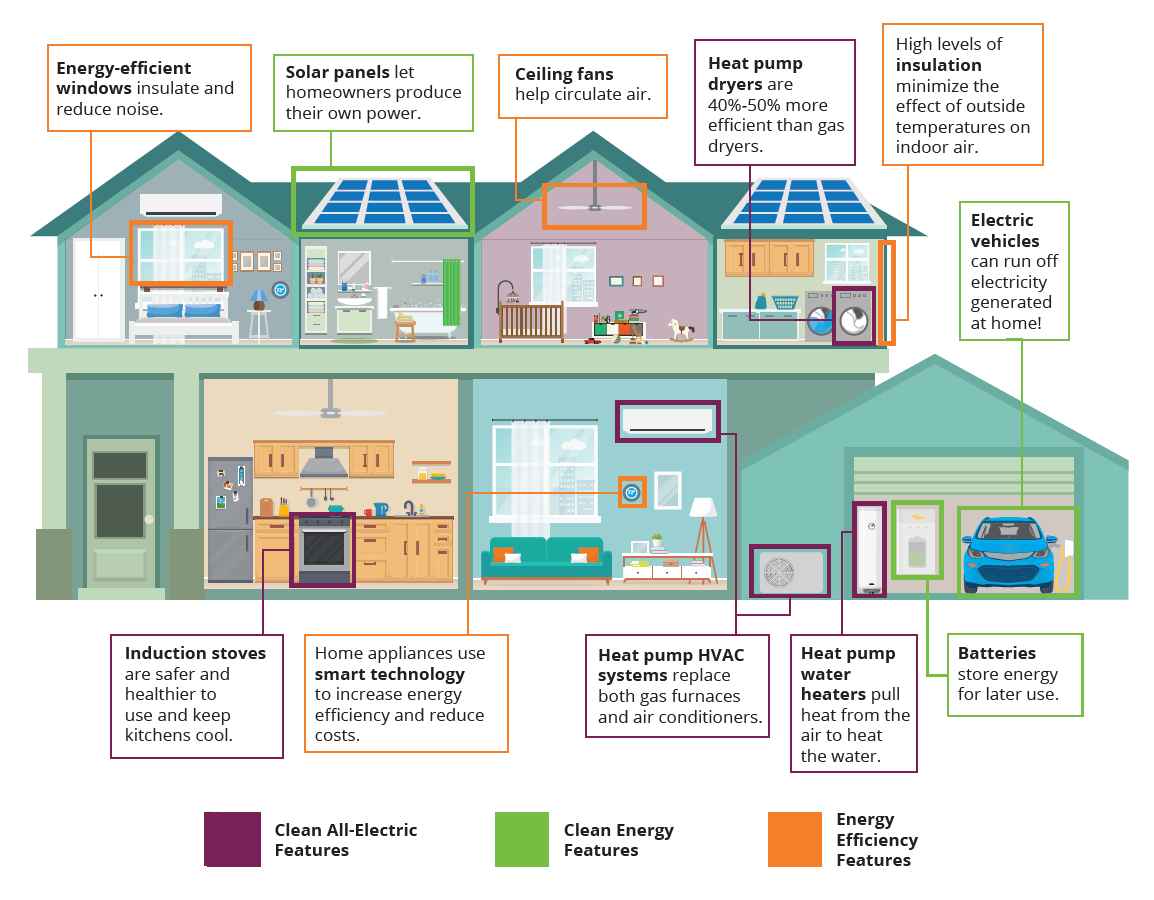

The energy package, consisting of the chosen improvements, is determined based on recommendations and analysis by a qualified home energy assessor. This can include energy-saving equipment, passive and active solar technologies, and materials required for the improvements.

For existing homes, the improvements must be cost-effective, meaning the money saved on energy bills should be greater than or equal to the cost of the improvements over their expected lifespan. A qualified home energy assessment is conducted to evaluate the home’s energy efficiency and analyze potential savings.

For newly constructed homes, the improvements must exceed the standards set by the most recent International Energy Conservation Code (IECC) adopted by HUD. The energy assessment determines which improvements meet or surpass the IECC standards.

The amount that can be financed for the energy package is capped at the lesser of a cost-effective improvement based on the assessment or a percentage of the property’s adjusted value, the median area price of a single-family dwelling, or the national conforming mortgage limit.

The EEM program can be combined with other FHA mortgage programs, such as the Section 203(k) Rehabilitation Mortgage Insurance program, which allows borrowers to finance various home improvements. Energy-efficient homes that meet minimum standards can also qualify for stretched qualifying ratios, allowing borrowers to qualify for higher loan amounts.

Additionally, FHA’s policy on solar and wind technologies permits borrowers to have a higher mortgage amount to cover the cost and installation of such systems at the time of home purchase or refinance. Weatherization expenses, such as thermostats and insulation, can also be financed up to $3,500 under FHA’s Weatherization policy.

Overall, the EEM program provides homeowners with opportunities to enhance their home’s energy efficiency, reduce utility costs, and finance energy-efficient improvements through their FHA-insured mortgage.

How to Get an EEM

To apply for an FHA-insured energy-efficient mortgage, contact an FHA-approved lender.

For More Information

Visit the FHA Resource Center to search the FAQs, ask a question or send an email.