Owning a home isn’t just a milestone; it’s a gateway to potential tax advantages that can significantly enhance your financial well-being. This comprehensive guide takes you deep into a wealth of homeowner tax deductions, offering an intricate exploration of each deduction’s eligibility criteria, advantages, and strategies for optimizing your savings.

Diving into Mortgage-Related Deductions

Mortgage Interest Deduction: Homeowners can deduct the interest paid on mortgages up to a specified limit, providing substantial relief, especially in the early stages of homeownership.

Property Tax Deduction: Reduce the burden of local property taxes by deducting a portion of these obligations, lightening your financial load.

Points Deduction: Homebuyers have the opportunity to deduct points paid to secure lower mortgage interest rates, delivering an upfront tax advantage.

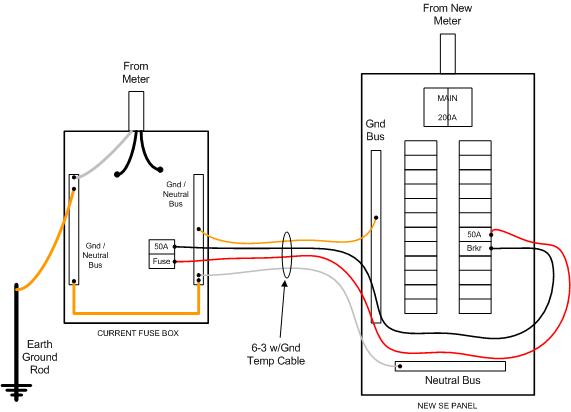

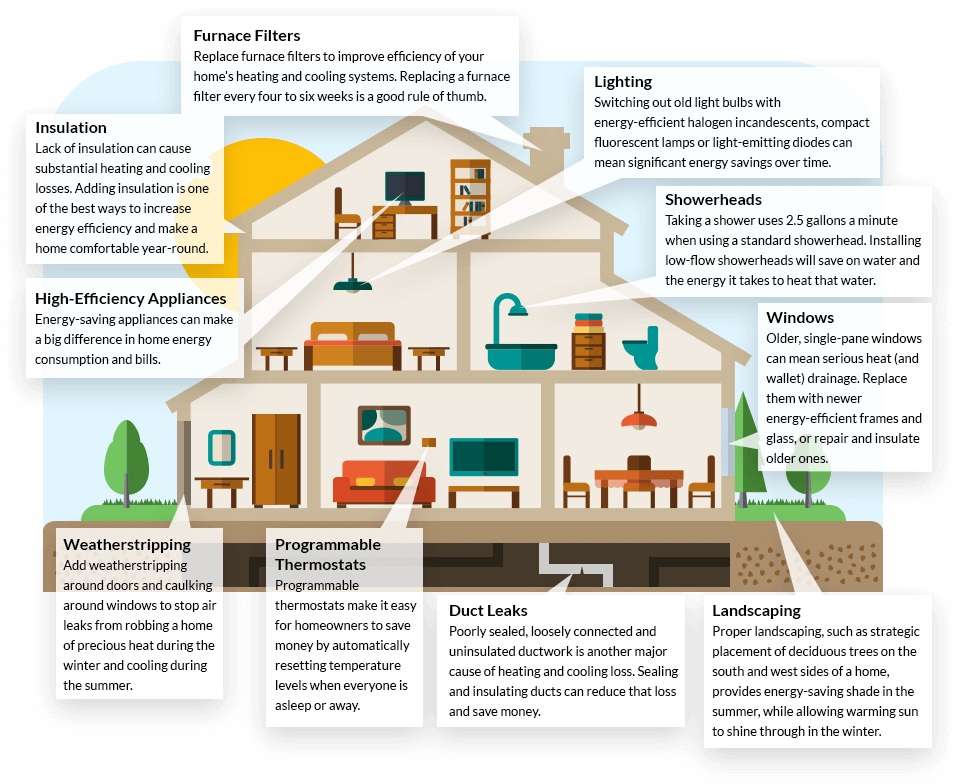

Home Improvement Loans Interest Deduction: Uncover deductions for interest payments on loans exclusively used for home enhancements, promoting environmentally conscious upgrades.

Energy-Efficiency and Green Upgrades

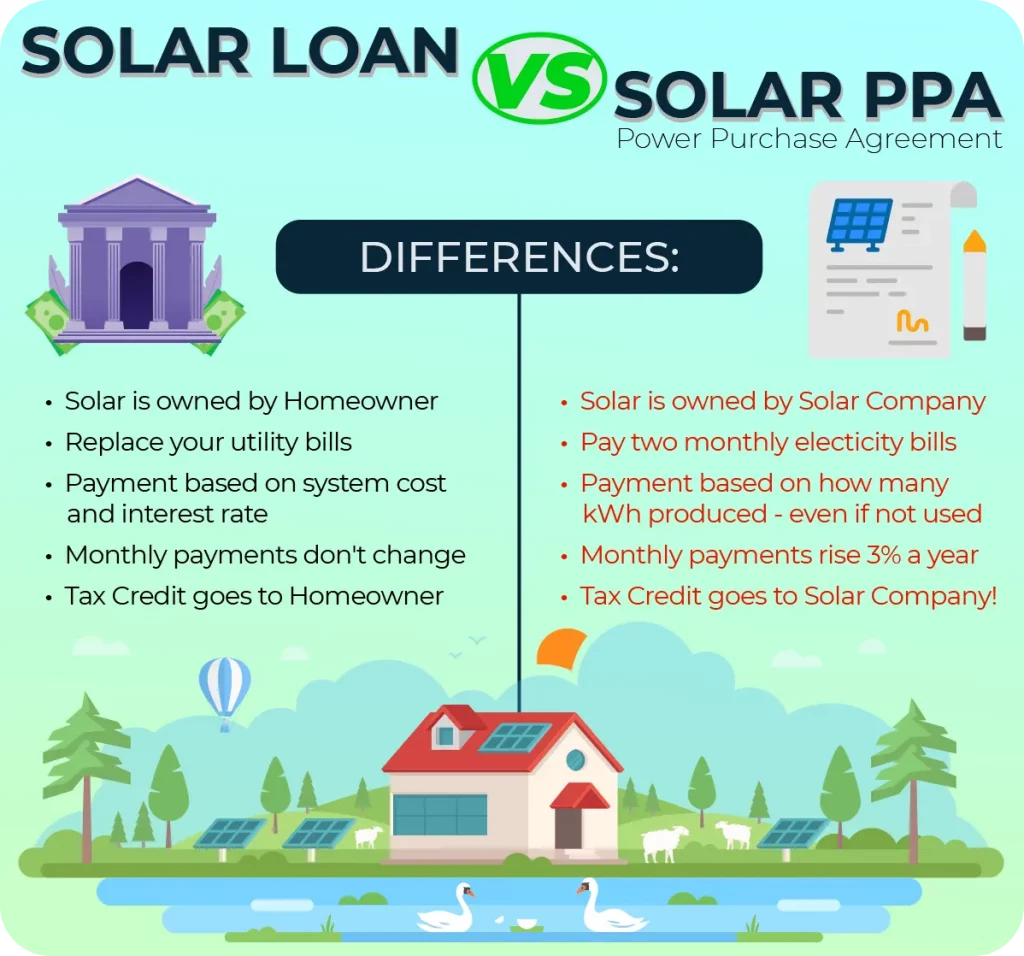

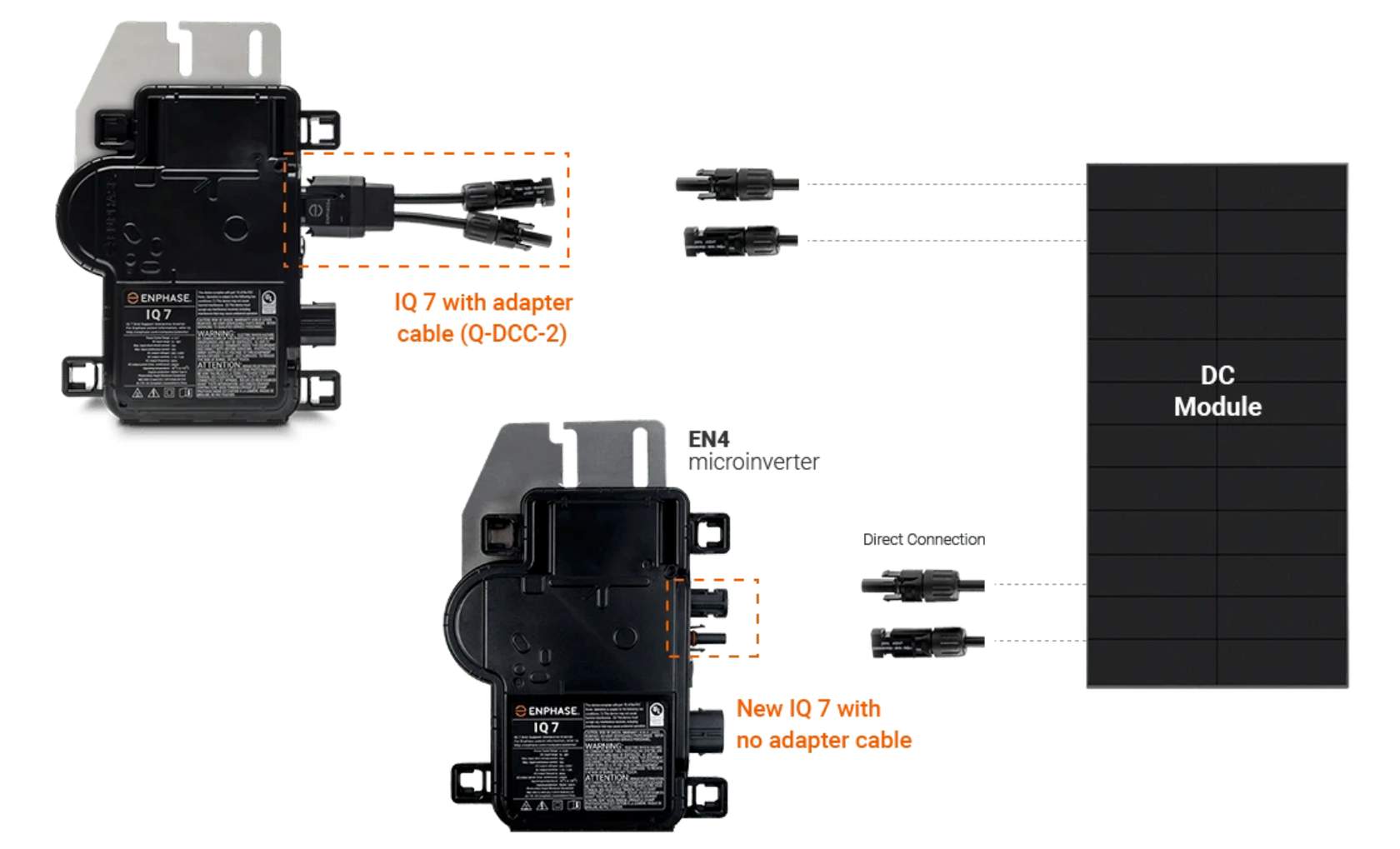

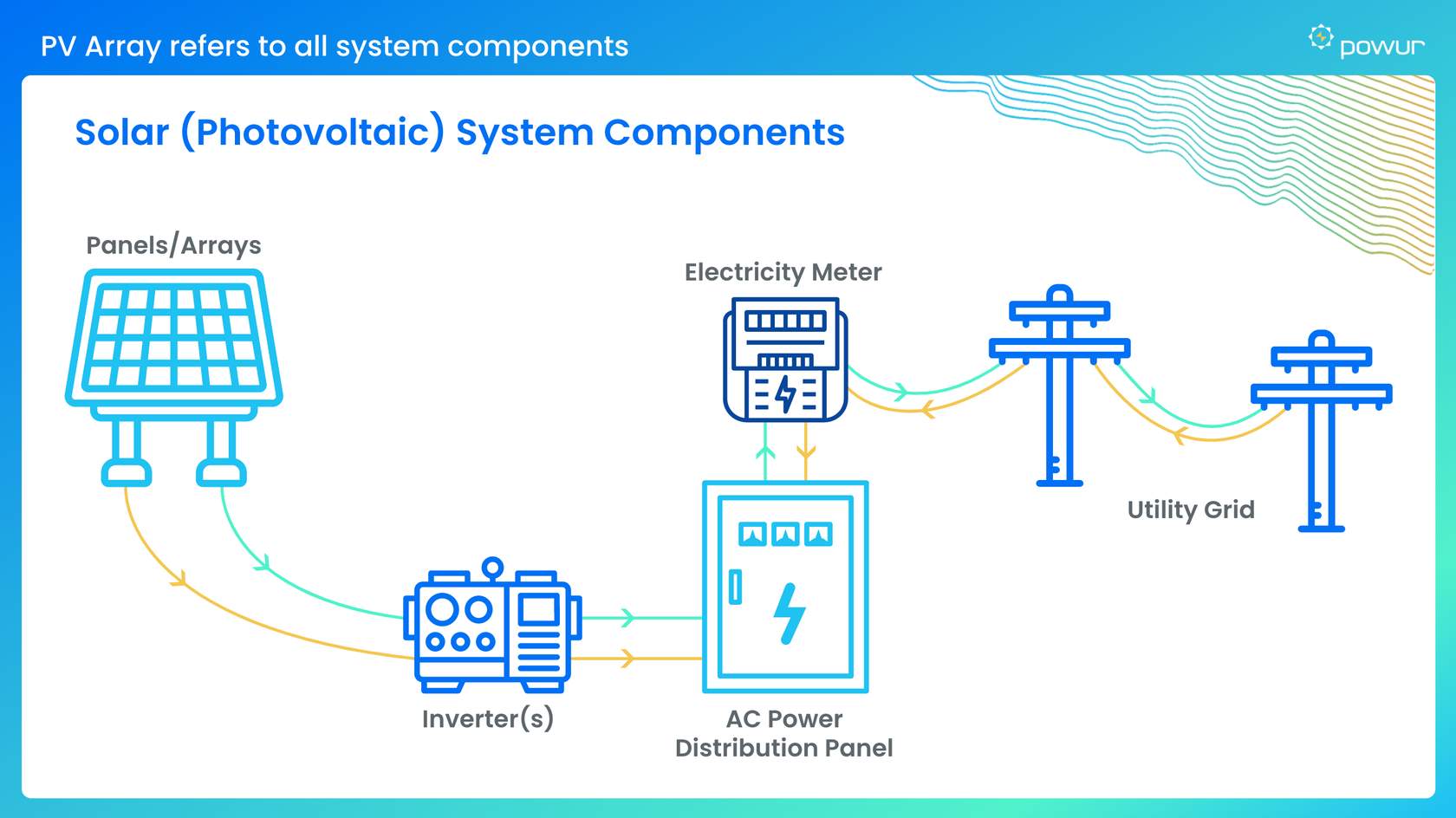

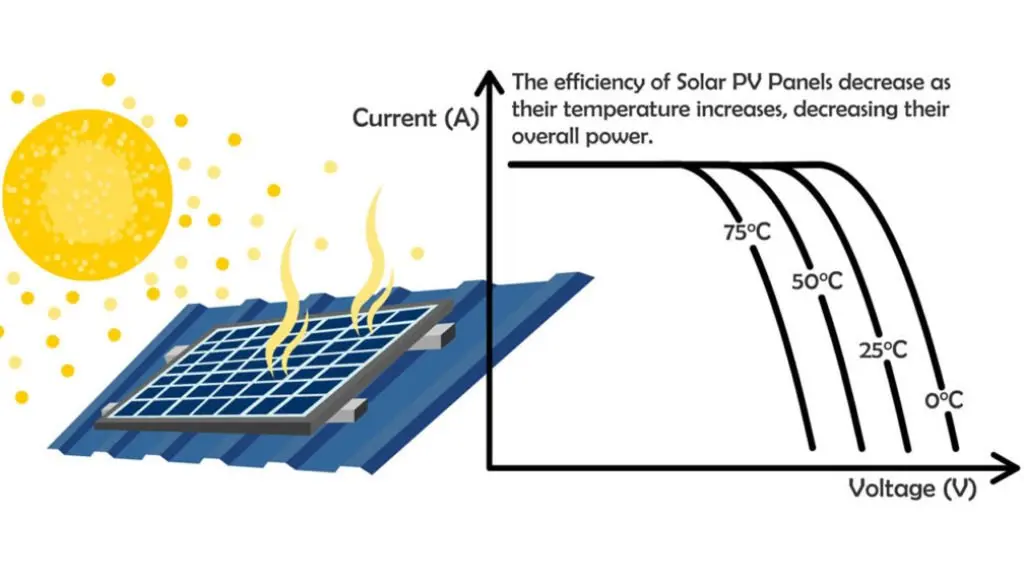

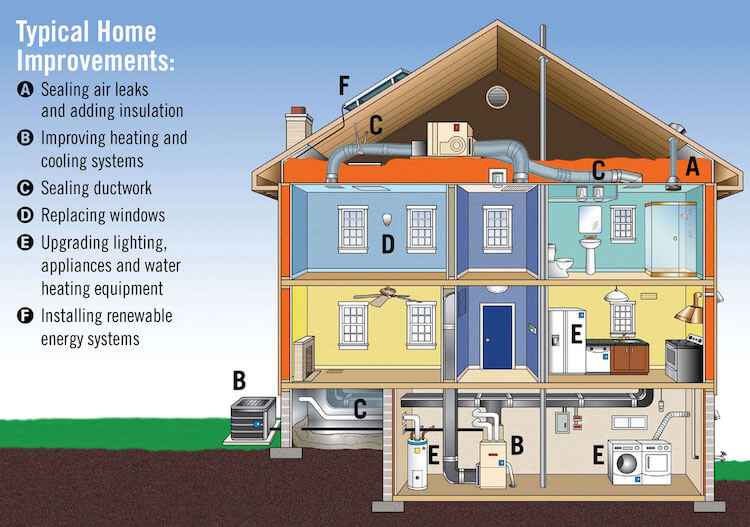

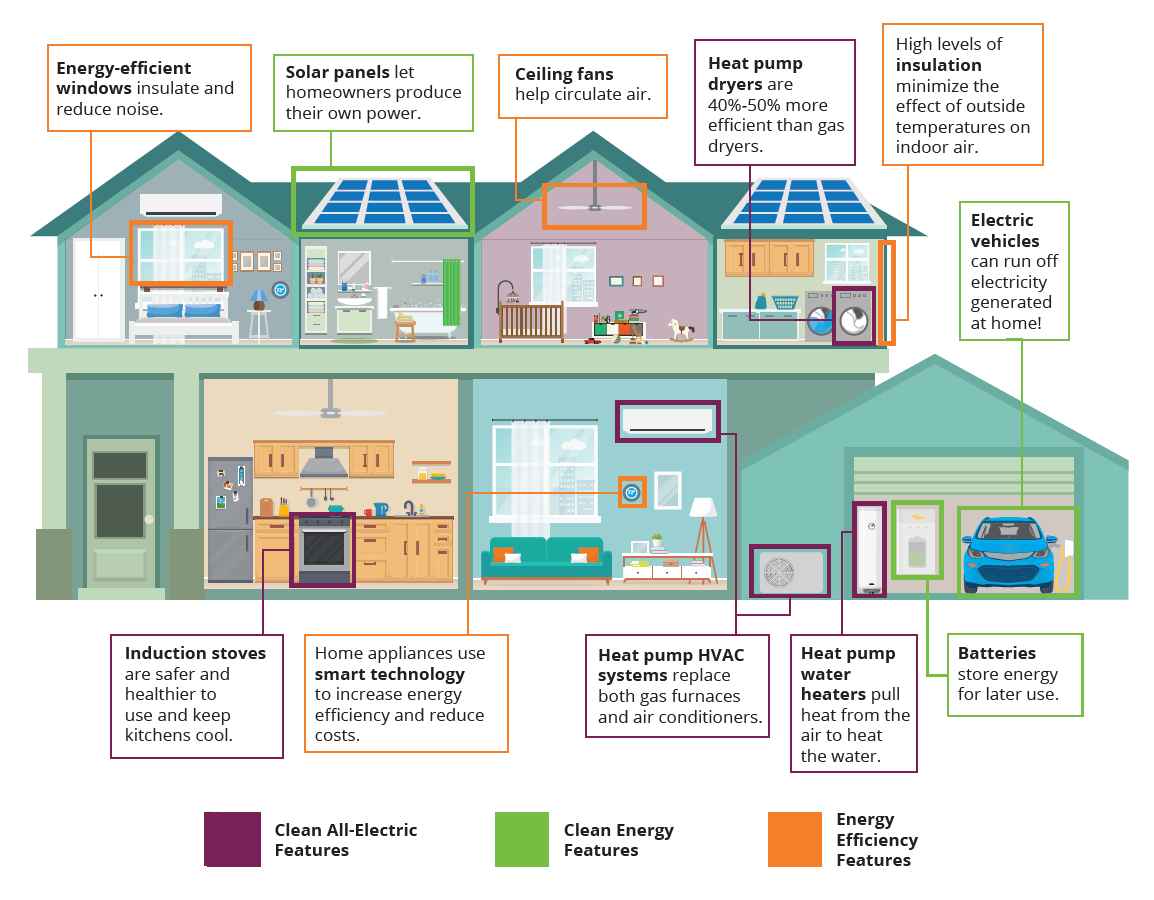

Energy-Efficiency Tax Credits: Learn about tax credits for energy-efficient home improvements like solar panels, windows, and insulation. Get insights into qualifying upgrades and the credit’s value.

Energy-Efficient Home Improvements Deduction: Discover deductions available for various energy-efficient enhancements. Understand eligible improvements and calculate deductible amounts.

Exploring Home Office and Business-Related Deductions

Home Office Deduction: Delve into deducting a portion of mortgage interest, property taxes, and utilities when part of your home is used for business. Learn about essential record-keeping practices.

Moving Expenses Deduction: Explore the criteria for deducting moving expenses linked to job-related relocations. Understand qualified expenses and distance requirements.

Embracing Homeownership Incentives

Solar Investment Tax Credit (ITC): Navigate the ITC process, including eligibility requirements, qualified solar energy systems, and the credit percentage. Empower yourself to harness solar power while trimming your taxes.

First-Time Homebuyer Credits: Gain insights into credits and deductions available to first-time homebuyers. Learn about potential savings and how to claim these benefits.

Medical Home Improvements Deduction: Grasp the guidelines for deducting medical home improvement expenses. Ensure you meet the criteria for this valuable deduction.

Historic Preservation Easement Deduction: Explore historic preservation easements and how they translate into tax deductions. Conserve heritage while optimizing tax savings.

Tackling Property Loss and Disaster Relief Deductions

Casualty Loss Deduction: Understand deducting losses from non-disaster events like theft or accidents. Comprehend documentation requirements and limitations.

Disaster Relief and Casualty Loss Deductions: Gain a comprehensive understanding of claiming deductions for property losses due to natural disasters. Learn about disaster relief provisions and available deductions.

Unveiling Other Deductions

State and Local Sales Tax Deduction: Explore deducting state and local sales taxes, including those on building materials for home improvements.

Loan Origination Fees Deduction: Uncover the intricacies of deducting loan origination fees, including eligibility rules and deductible amounts.

Interest Deduction on Home Equity Debt: Navigate the evolving landscape of deducting interest on home equity loans or lines of credit. Ensure compliance with changing tax regulations.

Home Sale Exclusion: Master the ins and outs of excluding a portion of capital gains from the sale of your primary residence. Understand qualifying criteria and potential tax savings.

Enhancing Benefits with Additional Incentives and Rebates

Expand your understanding of potential homeowner benefits with the following incentives:

Home Energy Efficiency Programs

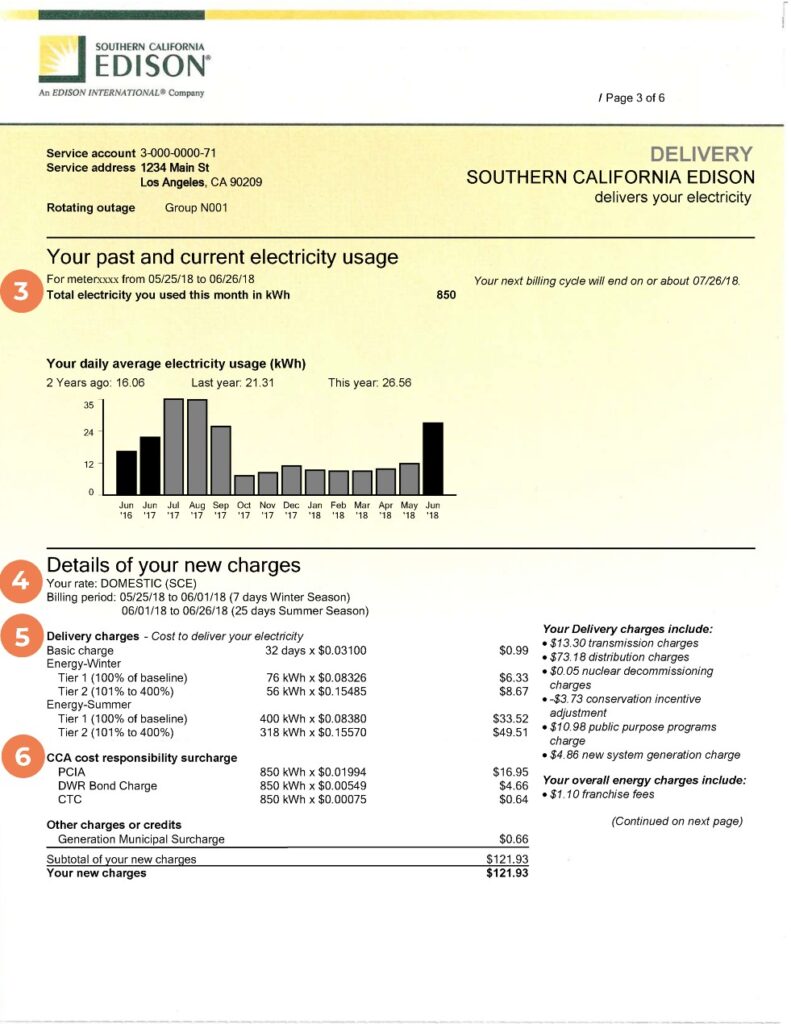

- Utility Rebates: Earn rebates from utility companies for energy-efficient upgrades.

- Weatherization Assistance Programs: Access free or reduced-cost improvements for insulation, weather stripping, and energy-efficient lighting.

Renewable Energy Grants and Loans

- Green Energy Grants: Secure grants for financing renewable energy projects like solar panel installations or wind turbines.

- Renewable Energy Loans: Utilize low-interest or zero-interest loans for funding renewable energy projects.

Water Conservation Rebates

- High-Efficiency Plumbing Fixtures Rebates: Receive rebates for replacing water-wasting plumbing fixtures with efficient alternatives.

- Rainwater Harvesting Incentives: Explore incentives for installing rainwater harvesting systems for non-potable uses.

Home Accessibility and Aging-in-Place Incentives

- Accessibility Upgrades Rebates: Qualify for rebates covering costs of home modifications for seniors and individuals with disabilities.

- Aging-in-Place Grants: Obtain grants to enable safe and comfortable aging in place.

Historic Preservation Tax Credits

- State Historic Tax Credits: Benefit from tax credits for rehabilitating historic properties.

- Federal Historic Rehabilitation Tax Credit: Qualify for federal tax credits when rehabilitating certified historic structures.

Community Solar Programs

- Community Solar Subscriptions: Participate in off-site solar energy generation through community solar programs.

Hybrid and Electric Vehicle Charging Incentives

- Charging Station Rebates: Receive rebates for installing electric vehicle charging stations.

- EV Tax Credits: Explore tax credits for purchasing electric or plug-in hybrid vehicles.

Disaster Resilience Grants

- Disaster-Resilient Home Upgrades: Access grants for fortifying homes against natural disasters.

In Conclusion

By delving into the nuanced realm of homeowner tax deductions, you unlock the potential to lower your tax liability and enhance your financial outlook.