Introduction

In the realm of providing solar energy solutions to homeowners, the right financial choice can significantly impact the journey. The pivotal step of financial qualification plays a crucial role in simplifying the decision-making process for homeowners, ensuring they aren’t overwhelmed by an excess of options. This article delves into the pivotal factors to consider when assessing a homeowner’s eligibility for different solar financing avenues. This approach streamlines the presentation and decision-making process, resulting in a more seamless experience.

Assessing Financial Eligibility

Determining financial eligibility involves a blend of personal financial elements and credit scores. An adept understanding of these components empowers solar providers to customize their recommendations according to a homeowner’s financial capacity. This approach not only enhances the presentation but also diminishes potential objections arising from unsuitable financial propositions.

Exploring Qualification Requirements for Financing

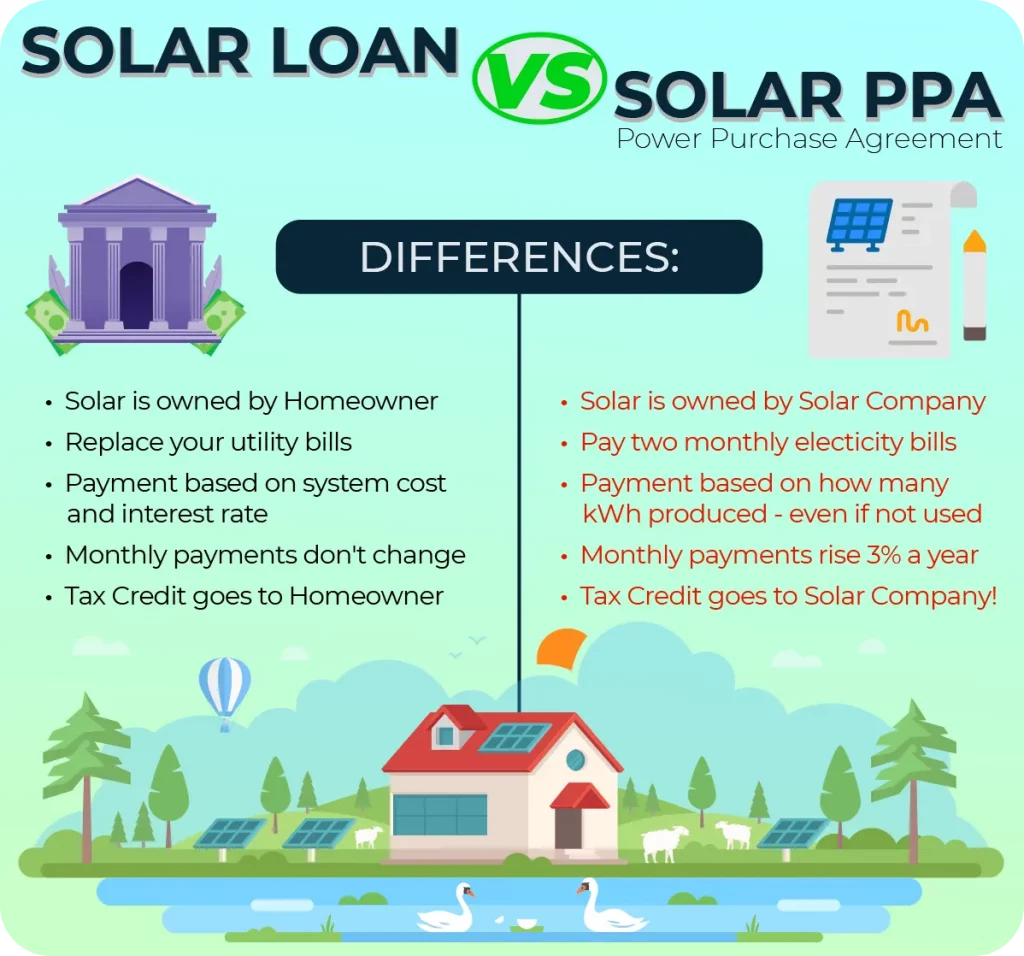

The solar industry offers diverse financing paths, each with its own set of prerequisites. These prerequisites are influenced by both market dynamics and the individual financial situation of the homeowner. Let’s delve into the eligibility criteria for two prevalent solar financing options: Cash Purchases and Solar Loans.

Eligibility Criteria for Cash Purchases

Cash purchases entice homeowners seeking annual returns on investment (ROI) ranging from 10% to 30%. While offering substantial benefits, this option requires a significant upfront cash commitment. The eligibility criteria for cash purchases are straightforward:

An initial deposit of $2,000.

Availability of adequate liquid funds to cover the contract amount.

Payment through personal check, money order, or ACH deposit.

Eligibility Criteria for Solar Loans

Solar Loans have garnered widespread popularity within the solar industry due to their favorable terms, similar to cash purchases. These loans come with varying interest rates, and My Solar Program provides a range of options to cater to individual customer needs. Although eligibility criteria for solar loans are generally straightforward, they differ based on the chosen financing partner.

Credit Requirements for Solar Loans

Credit checks are a standard element of the financing application process and must be carried out under the homeowner’s name as listed on the property title. A minimum credit score of 650 is typically required, although some financial partners accept scores above 600. The credit score determines approval conditions:

Credit score above 700: No additional conditions.

Credit score between 600 – 699: Additional conditions might apply.

These extra conditions may encompass factors such as no recent bankruptcy within the past five years, a debt-to-income ratio of 55%-65%, and meeting specific household income prerequisites. The credit score also influences the borrowing capacity, with scores above 700 often qualifying for loans up to $150,000, whereas scores between 600 – 699 might limit loans to $70,000.

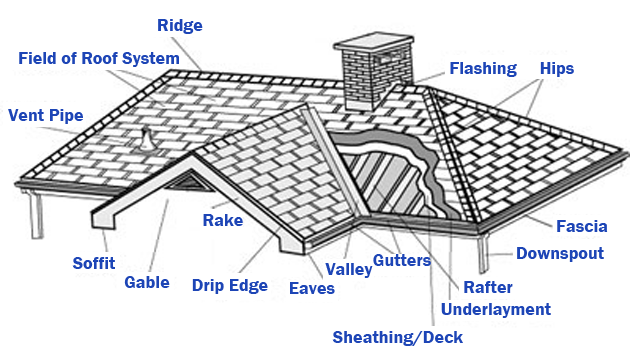

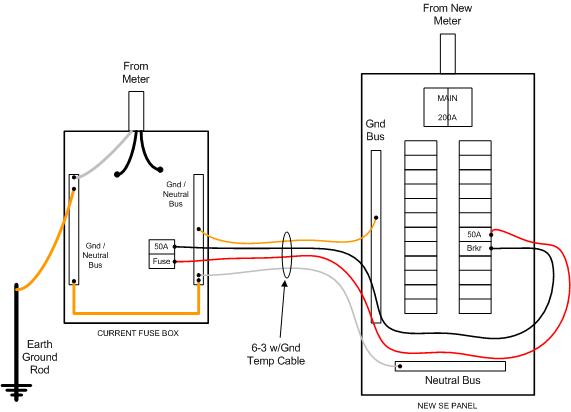

Property Eligibility and Lender-Specific Criteria

Certain property types are eligible for solar financing, including single-family homes, second homes (not for rental), duplexes, townhouses, row homes, and condominiums (if the homeowner owns the roof). However, not all properties meet the criteria; for example, vacation rentals, multi-family homes with 5+ units, mobile homes, and commercial properties are generally ineligible.

Lenders often impose specific requirements beyond credit scores and property type:

Loan Minimum: Solar loans might have a minimum borrowing amount, often around $10,000.

Annual Income Minimum: Borrowers should possess an annual income exceeding $10,000.

Title Requirement: At least one borrower must be listed on the property title.

Advantages of Pre-Qualification and Information Gathering

Pre-qualifying homeowners for a solar loan offers several benefits. By collecting basic details like name, address, and gross household annual income, providers can swiftly assess eligibility and offer viable options. Pre-qualification inquiries don’t affect the homeowner’s credit score and can streamline the decision-making process. Although not all homeowners can be pre-qualified with minimal information, those meeting the criteria can confidently proceed toward their solar installation.

Conclusion

Grasping financial qualification forms the bedrock of successful solar proposal presentations. By understanding the interplay of personal finances and credit scores, solar providers can guide homeowners toward the most fitting financing avenue. Armed with a clear comprehension of eligibility criteria, providers can customize recommendations, address concerns, and ultimately facilitate a smooth transition to sustainable solar energy.