The property-assessed clean energy (PACE) model is an innovative mechanism for financing energy efficiency and renewable energy improvements on private property. PACE programs exist for:

- Commercial properties (commonly referred to as Commercial PACE or C-PACE).

- Residential properties (commonly referred to as Residential PACE or R-PACE).

Commercial and Residential PACE Programs: Revolutionizing Property Improvement Financing

Common Foundation of PACE Programs

PACE programs share a fundamental principle that allows property owners to finance the upfront expenses of energy or eligible enhancements and subsequently repay the costs over time via voluntary assessments. A distinguishing feature of PACE assessments is their connection to the property rather than an individual.

A New Paradigm in Financing: PACE’s Structure

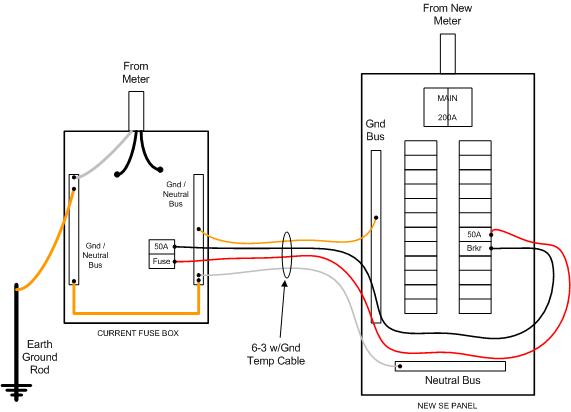

PACE financing for clean energy initiatives is typically built upon a pre-existing structure known as a “land-secured financing district.” Often referred to as an assessment district, local improvement district, or similar terms, this framework has traditionally enabled local governments to issue bonds for public-purpose projects such as streetlights, sewer systems, or utility lines.

Extending the Model to Energy Efficiency and Renewable Energy

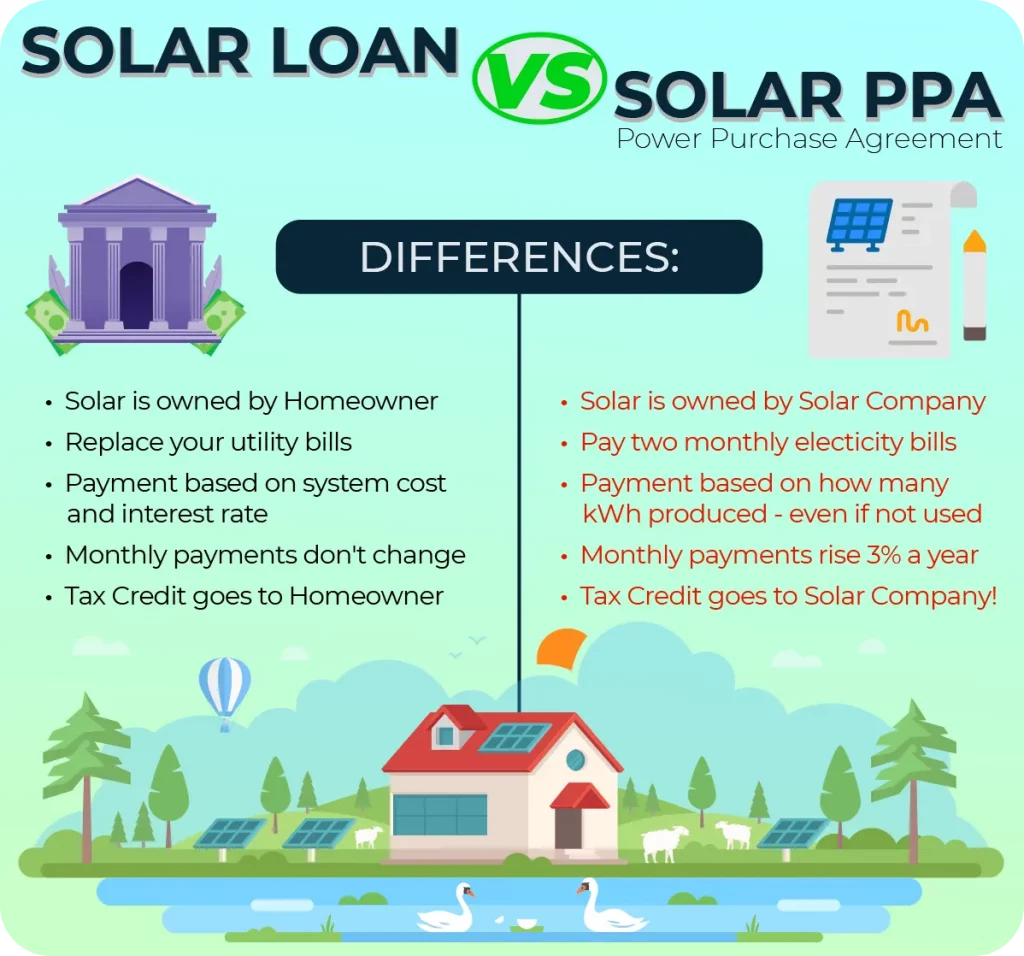

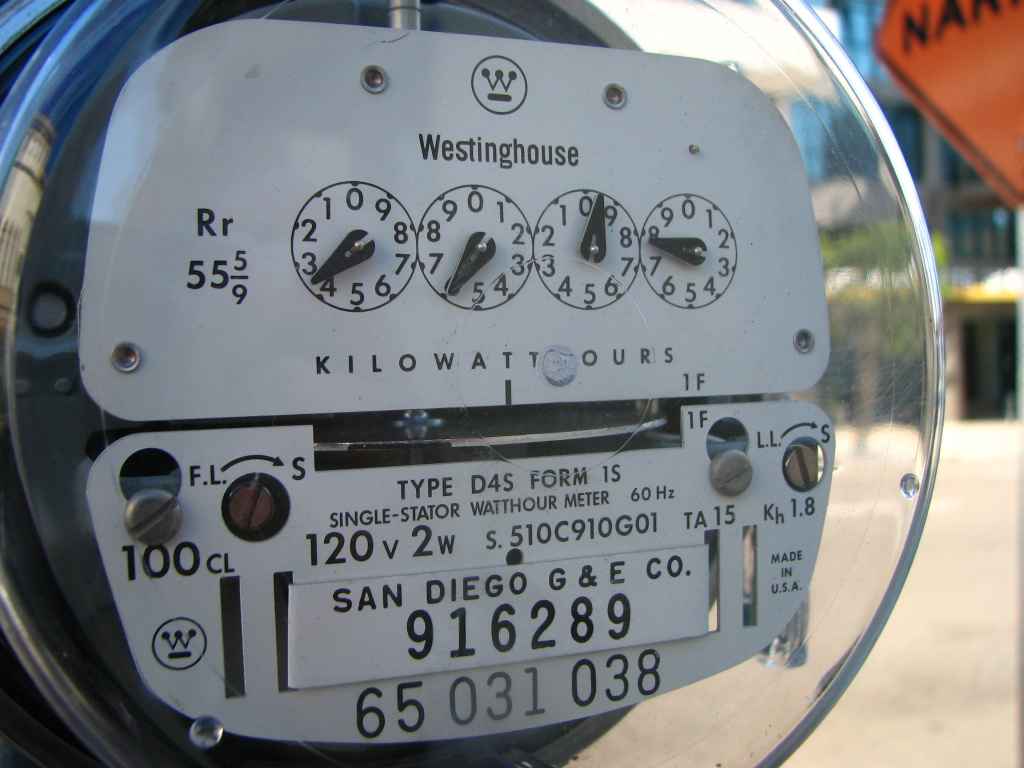

Recent advancements have expanded this financing model to encompass energy efficiency and renewable energy projects. This extension empowers property owners to implement improvements without a significant upfront payment. Participants in a PACE program voluntarily cover improvement costs over a predetermined period—usually 10 to 20 years—via property assessments. These assessments are tied to the property, paid as an addition to property tax bills. Failure to pay results in consequences akin to neglecting other portions of a property tax bill.

Transferrable and Property-Tied Obligations

A notable characteristic of PACE assessments is that they are tied to the property itself, not the property owner(s). When property ownership changes hands, the repayment responsibility may shift if the buyer agrees to assume the PACE obligation and the new primary mortgage holder permits the obligation to persist. This addresses a significant disincentive for property improvement investments, as owners may hesitate to invest if they plan to sell the property before reaping the benefits of savings on upfront costs.

Advantages

- Facilitates secure, extended-term financing for comprehensive projects, enhancing cash flow positivity.

- Distributes repayment across years, often eliminating the need for upfront payments and the requirement to settle debt during property sale or refinance.

- Potentially leads to lower interest rates due to the secured nature of repayments tied to property tax bills.

- Enables property owners to deduct payments from their income tax liabilities.

- Empowers municipalities to promote energy efficiency and renewables without risking general funds.

- Attracts significant private capital for funding.

Disadvantages

- Limited to property owners’ eligibility.

- Unsuitable for funding portable items like light bulbs or standard refrigerators.

- May necessitate dedicated local government staff time.

- Can involve substantial legal and administrative setup obligations.

- Not suitable for investments below $2,500.

- Potential resistance from lenders/mortgage holders with claims to the property, as their interests may be secondary to unpaid assessment amounts during property foreclosure.

Commercial PACE

C-PACE programs exist in several states, regions, and local governments. Programs vary across several dimensions including the level of organization (statewide vs. local programs), financing structures, and eligible measures. More than 37 states plus the District of Columbia have C-PACE enabling legislation and more than $2 billion in projects have been financed.

C-PACE Toolkit

The C-PACE Toolkit is a four-part compilation of resources that any state or local government can use to navigate barriers and benefit from C-PACE financing. Toolkit resources support best practices and innovative approaches successfully used by states and local governments to establish, join, or design a C-PACE program, implement a program and generate project uptake, and apply C-PACE to support underserved communities or advance resilience objectives.

Resources

Residential PACE: Empowering Homeowners for Energy Efficiency

Private Capital for Home Improvement

Residential PACE provides homeowners with a groundbreaking opportunity to finance a range of home enhancements, from energy efficiency to renewable energy projects, using privately sourced capital. These programs are established under state legislation and are granted authorization at the local government level. The administration of residential PACE initiatives can be carried out directly by municipalities or in collaboration with public-private partnerships involving one or more PACE service providers.

Impressive Progress and Benefits

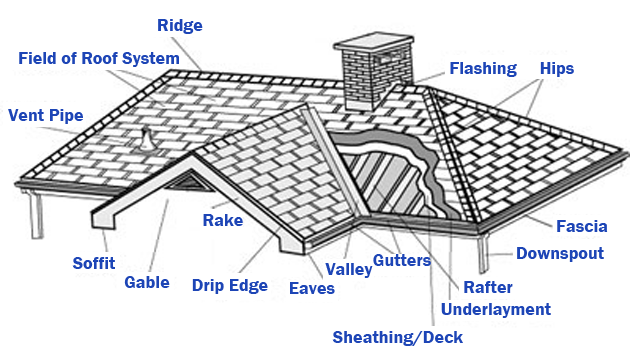

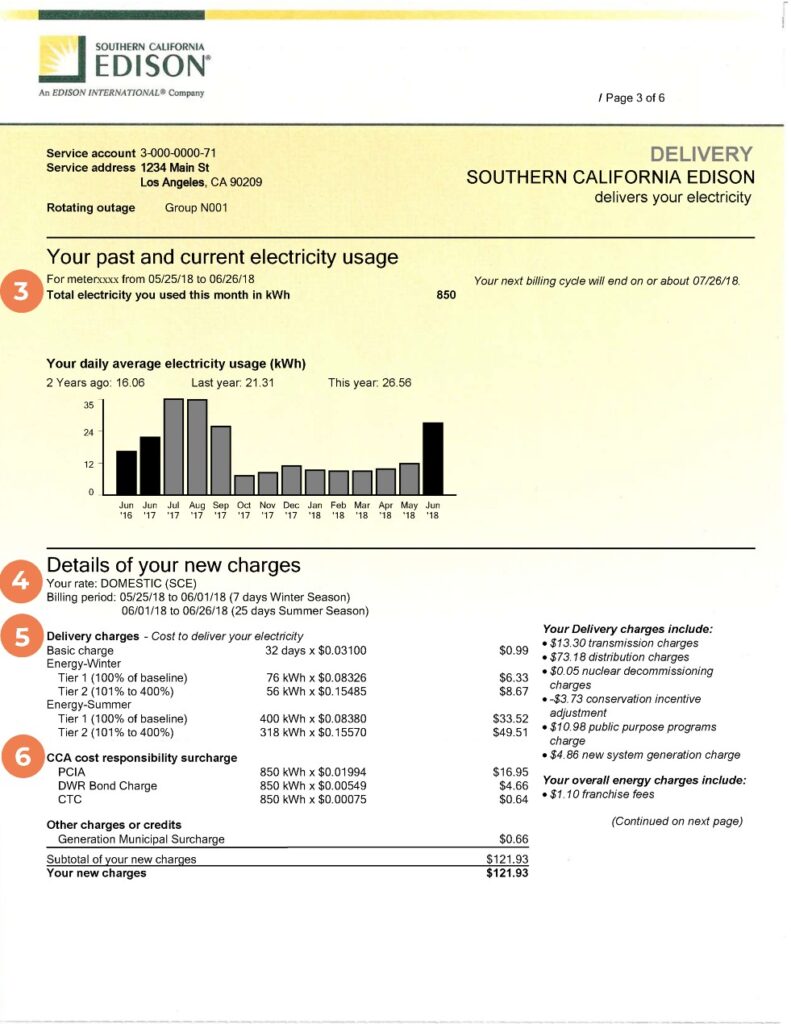

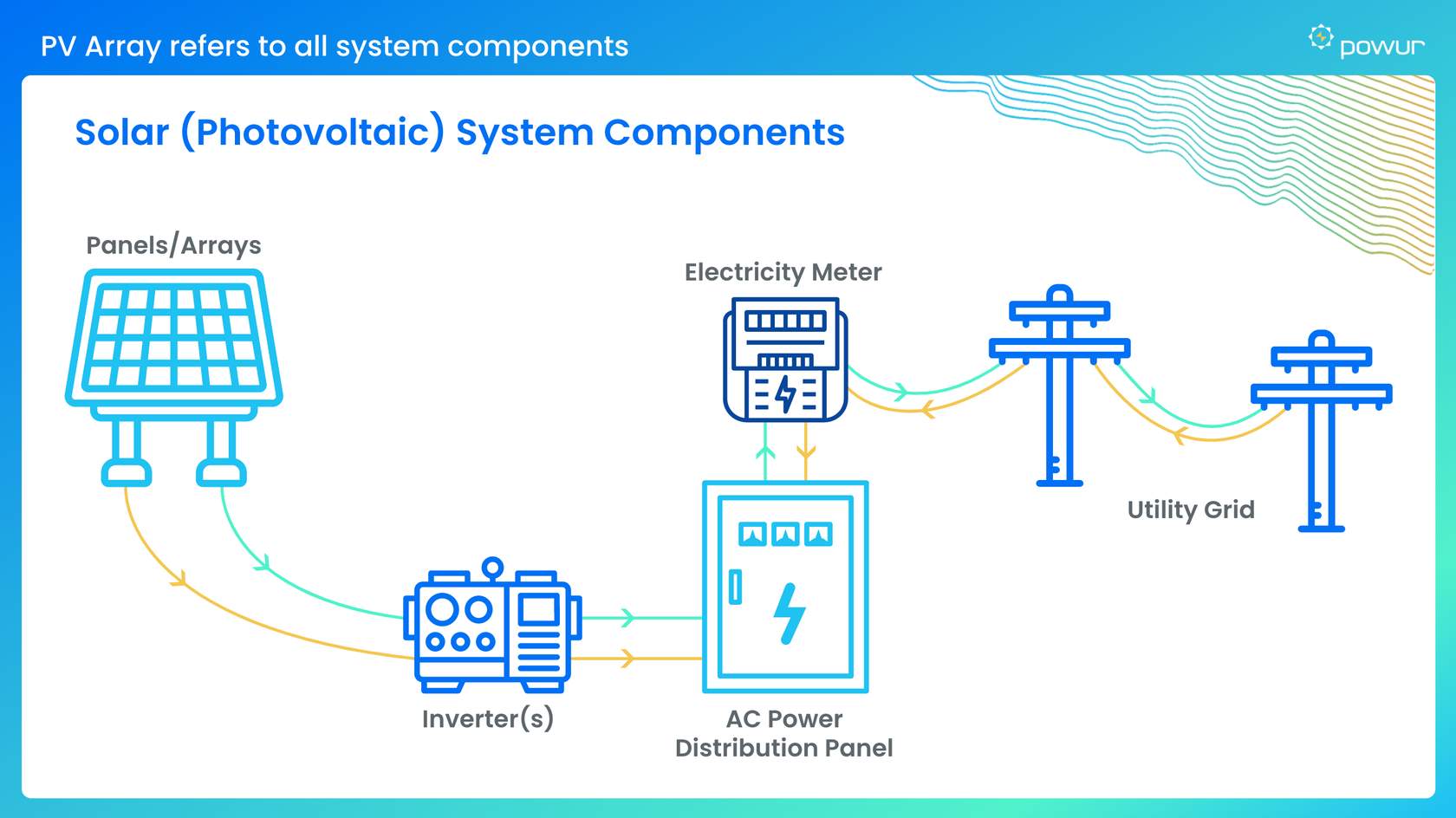

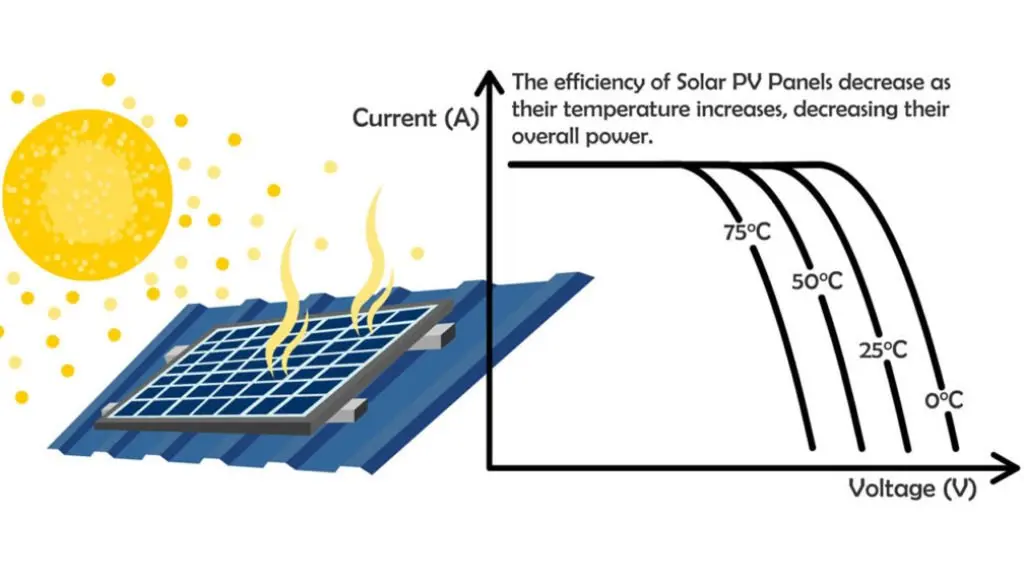

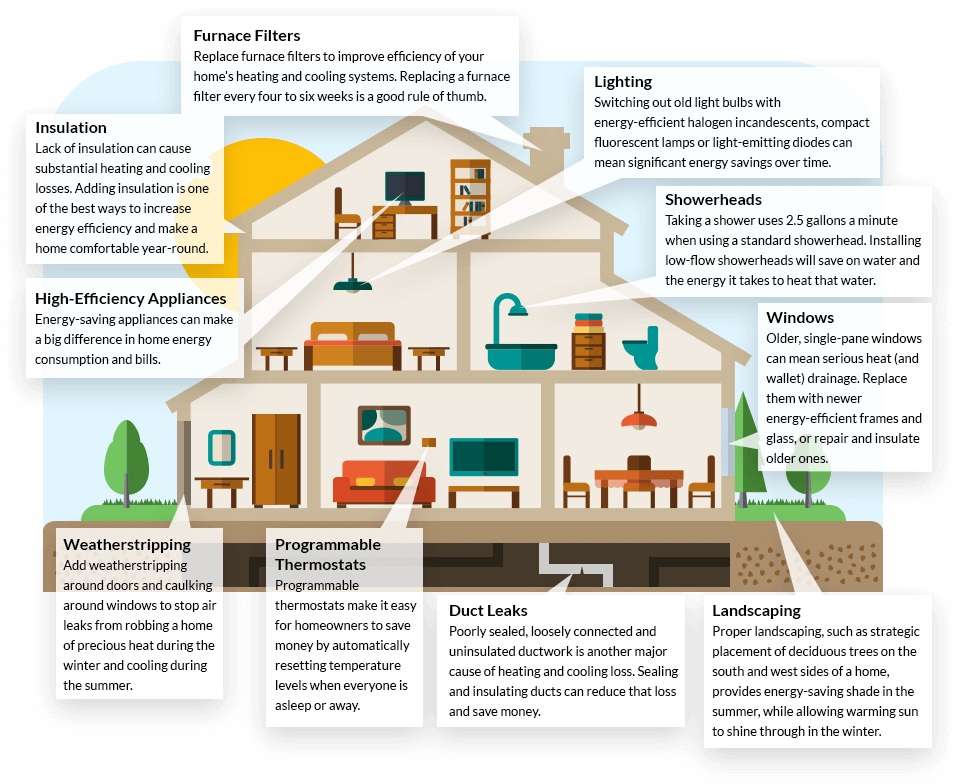

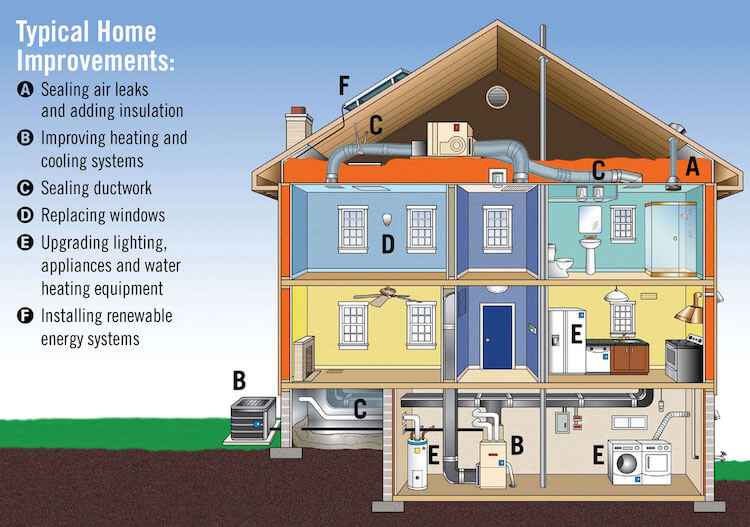

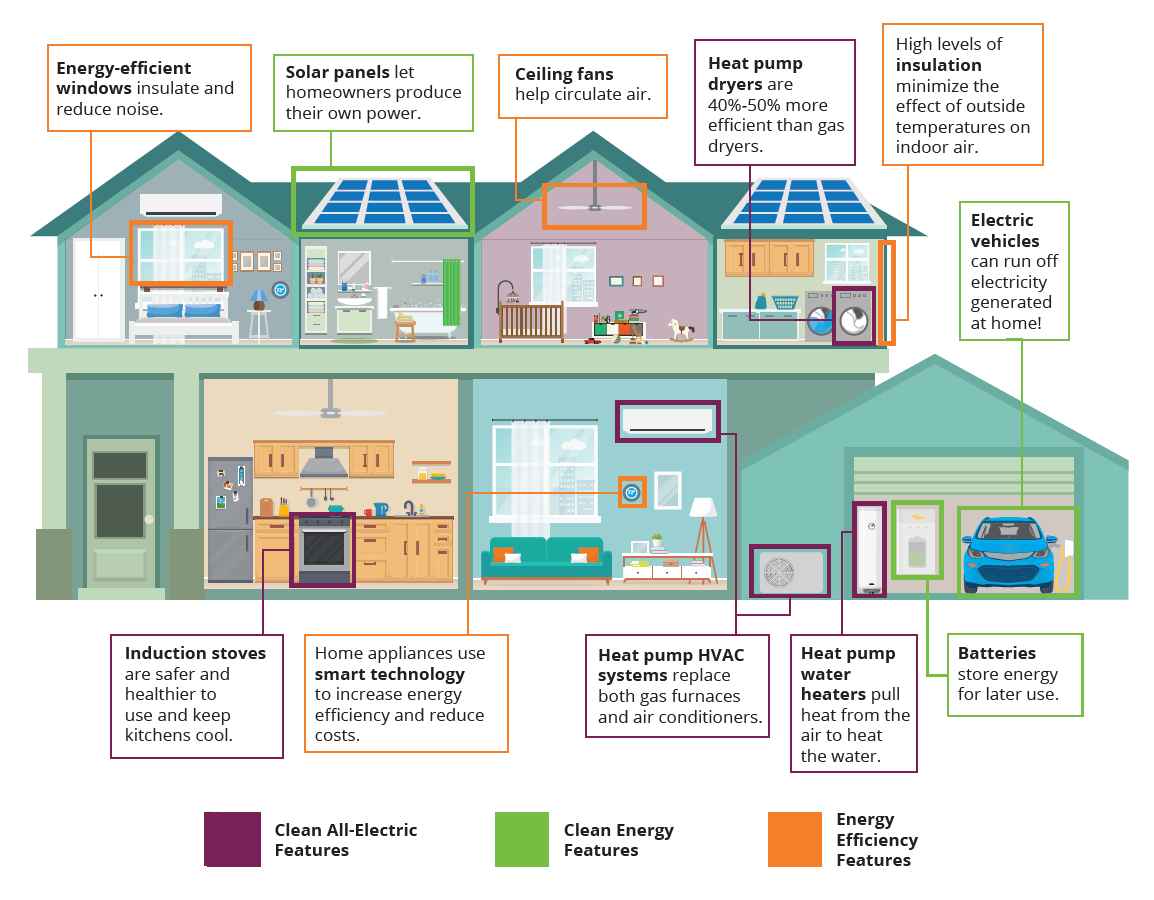

As of 2019, more than 200,000 homeowners have leveraged $5 billion in funding to enhance energy efficiency and implement various improvements in their homes through PACE financing. These improvements often encompass critical areas such as replacing malfunctioning heating, cooling, and water heating systems, bolstering air sealing and insulation, adopting ENERGY STAR-rated doors, windows, and roofing, integrating energy-efficient appliances, installing solar photovoltaic systems, and embracing water conservation and resilience measures such as seismic retrofits and wind hazard protection.

Current Residential PACE Availability

Residential PACE financing programs are currently accessible in the following states:

- California: Hosts 10 active programs.

- Florida: Offers 4 active programs.

- Missouri: Features 3 active programs.

These states are leading the way in enabling homeowners to enhance their residences’ energy efficiency and overall sustainability through the innovative framework of Residential PACE.

Resources

Additional Resources

- PACENation Resources

- NASEO Publications: Accelerating the Commercial PACE Market