- December 2, 2022

- admin

- 0

Updated

Electric vehicles (EVs) are rising in popularity all over the United States, but this is especially true in California. According to the most recent count, there are 563,070 EVs registered in the Golden State, and around 79,023 charging stations in place to keep their batteries full. That’s the largest amount of public charging stations in the whole country!

We can assume that electric cars are so popular in California due to their more environmentally conscious population. But, it’s also because the incentives available for California residents make EVs incredibly appealing.

New vehicles qualifying for rebates and incentive programs help to bring down the purchase price of EVs, making EV ownership easier and more attractive to more prospective buyers.

If you meet the eligibility requirements for each incentive, you can reduce the sticker cost of a car by up to thousands of dollars. Let’s find out how.

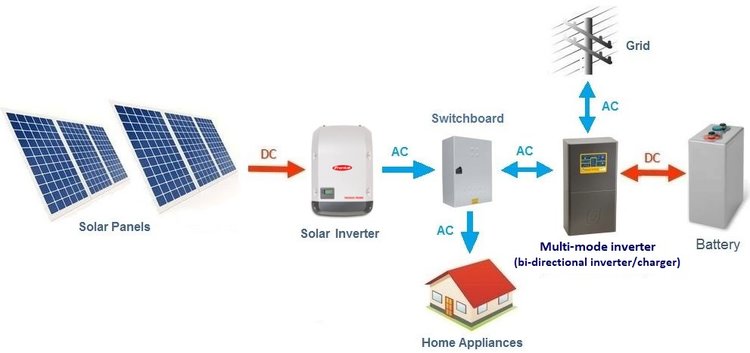

Find out how much you can save by charging your EV with solar panels

California EV incentives at a glance

- Californians who purchase electric vehicles can get incentives ranging from $750 all the way up to $7,000 from the state thanks to the Clean Vehicle Rebate Project and the California Clean Fuel Reward.

- In addition to state incentives, California EV buyers can also take advantage of the federal EV tax credit to help reduce the cost of their purchase.

- Don’t leave any money on the table – make sure to check websites that can match your location with the incentives available to you.

On this page

California state-specific incentives

California’s residents have access to two incentives to help reduce the buying cost of an EV:

- Clean Vehicle Rebate Project

- California Clean Fuel Reward

Clean Vehicle Rebate Project (CVRP)

The CVRP rebate program offers between $1,000 and $7,000 if you buy or lease an EV. The savings amount varies based on where you live, your electric utility provider, your household income, and the car type.

You can calculate your savings and eligibility via the program’s official website. For a quick assumption, most EVs are either all-electric zero-emissions vehicles or plug-in hybrids, so you can expect to save at least $1,000.

| Vehicle type | Rebate range |

| Fuel cell vehicle | $4,500-$7,000 |

| All-electric vehicle | $2,000-$4,500 |

| Plug-in hybrid EV | $1,000-$3,500 |

California Clean Fuel Reward

Supported by the California Air Resources Board, a California resident can receive a $750 rebate by purchasing an EV from a participating car dealership. To be an eligible vehicle, the battery must be over 5 kilowatt-hours (kWh) and the car owner must reside in and register the vehicle in California.

Before you buy an EV, you may be able to get some cash by trading in your old car through the Vehicle Retirement Customer Assistance Program. If your car qualifies, you could receive up to $1,000 to trade in your gas guzzler while low-income residents can receive up to $1,500. You can find out if you qualify via the site’s application.

What are other EV incentives available?

In terms of local incentives, there are too many to list. More often than not, each specific town or municipality offers EV rebates and incentives.

For instance, the Bay Area of California offers a few added perks for the people who live there through the Bay Area Clean Cars for All program. The program offers grants of up to $9,500 for low-income residents purchasing fully electric vehicles. The Bay Area also offers a $1,200 rebate for car owners to trade in old EVs.

EV and plug-in hybrid electric vehicles also get the added benefit of being able to drive in the HOV lane even without a carpool buddy. Plus, some local utilities even offer rebates for residential customers to install home charging stations. For example, homeowners in Anaheim can receive a rebate of up to $1,000 if they install a level 2 charger in their homes.

There might be other incentives that you qualify for since each location can vary. Be sure to enter your information to find out how much you can save.

California isn’t just offering incentives to get more EVs on the road. The California Air Resources Board voted on August 25, 2022 to approve rules that will reduce the sale of gas-powered cars in the state to 0 by 2035. The Biden administration needs to approve the new requirements before the plan can be put in place. If approved, the amount of gas-powered cars allowed to be sold in the state will be reduced each year until 2035, when 100% of new car sales must be plug-in hybrid, hydrogen fuel cell, or fully electric.

Do California drivers qualify for the federal EV incentive?

Yes, California drivers do qualify for the federal EV tax credit. In 2022, the tax credit is equal to $7,500 and can be used to purchase electric vehicles and plug-in hybrids. But, not all cars qualify – the vehicle manufacturer cannot have sold more than 200,000 EVs as of the date of purchase, and the car must be assembled in North America.

Thanks to the passing of the Inflation Reduction Act (IRA), there will be a whole new set of criteria EVs need to meet in 2023 to get the $7,500 tax credit. There will even be a tax credit for buying a used EV. But, the new EV tax credit is a bit more challenging to qualify for because the car and battery need to meet stringent manufacturing requirements, your income must be below a certain threshold, and the car’s MSRP cannot exceed a certain limit.

The new incentives were created to encourage United States-based manufacturing and to help lower-income earners. Rebates, like a lot of the California incentives, on the other hand, are available with no strings attached – the amount you are owed is the amount that you get.

What is the most you can save on an EV in CA?

Assuming that you happen to live in a location without any local incentives, which isn’t likely, the most you can save on an EV in California is $14,750. This is the best case scenario if you qualify for the Clean Vehicle Rebate Project, the California Clean Fuel Reward, and get the entire federal incentive amount.

This is unlikely, though because to get the full amounts of the two California-specific rebates, you would have to meet all of the low-income requirements. If that’s the case, you probably wouldn’t owe $7,500 in taxes to take advantage of the full $7,500 federal incentive, which is capped at how much you owe in taxes.

But, the IRA has made it so you can actually transfer that $7,500 to the dealer and use it as a down payment on the car. This way, even if you do not owe $7,500 in taxes, you can still benefit from the full incentive amount.

The good news though is that as a California driver, extra incentives are available to you and your new EV that make owning one in California a great choice. From Sacramento to Southern California, you’ve got options to make an EV the car for you.