As more Americans consider the transition to solar energy, they are presented with a range of financial incentives to facilitate the switch. One of the most significant incentives is the Federal Investment Tax Credit (ITC), commonly known as the Solar Tax Credit. This credit serves as a major draw for homeowners embracing solar energy, offering potential savings in taxes. To capitalize on this opportunity, individuals must correctly claim the credit using Form 5695. If you’re wondering about the process of completing Form 5695 to claim the Solar Tax Credit, this article provides a comprehensive step-by-step guide to help you navigate the process and secure the credit you deserve.

Understanding the Solar Energy Tax Credit

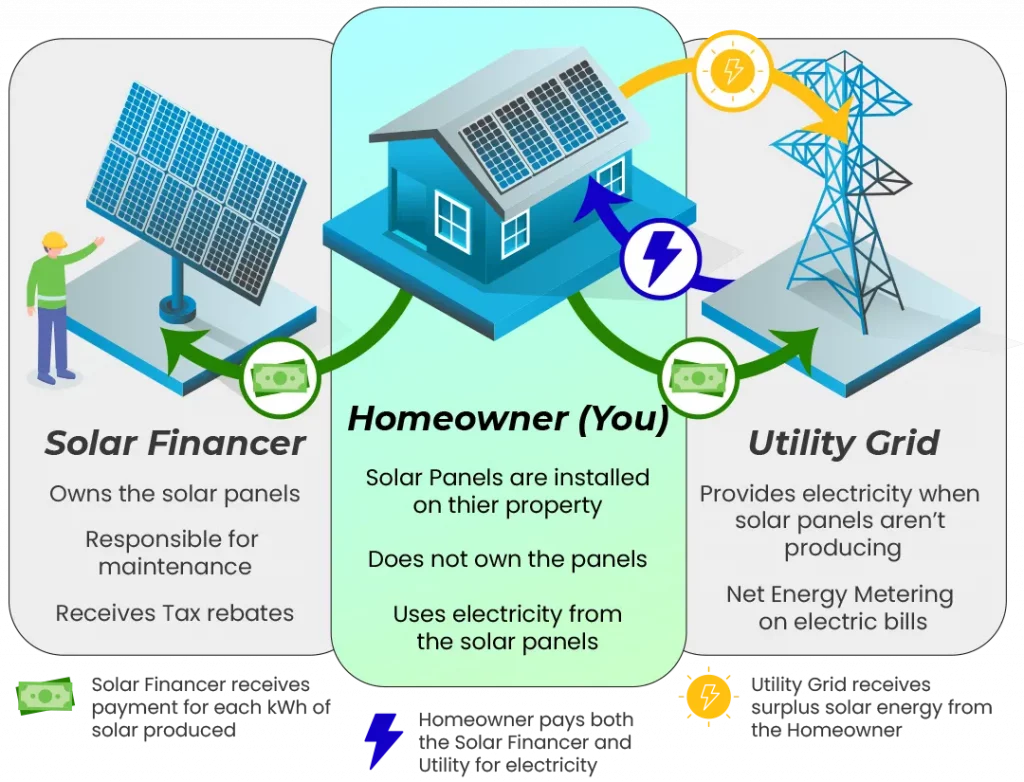

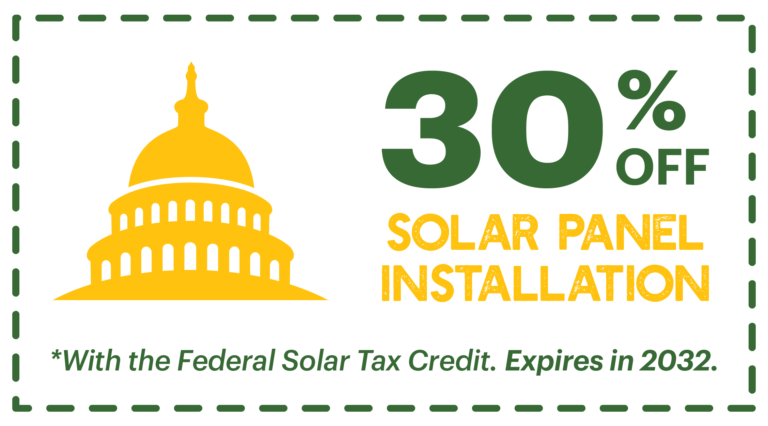

The Solar Tax Credit is a federal tax credit that can be claimed on income taxes, resulting in a reduction of federal tax liability. The credit is calculated based on a predetermined percentage (typically 30%) of the total cost of a solar energy system. As of now, the Solar Energy Tax Credit offers a 30% credit until December 31, 2032. Following this date, the credit gradually decreases to 26% in 2033 and 22% in 2034.

The Federal Investment Tax Credit, extended by the Inflation Reduction Act of 2022, not only makes solar energy more affordable by providing a dollar-for-dollar reduction in taxes but also encourages sustainable choices. To qualify for the credit, your solar energy system must have been initiated within the current tax year, and IRS Form 5695 is necessary for the claim.

What is IRS Form 5695?

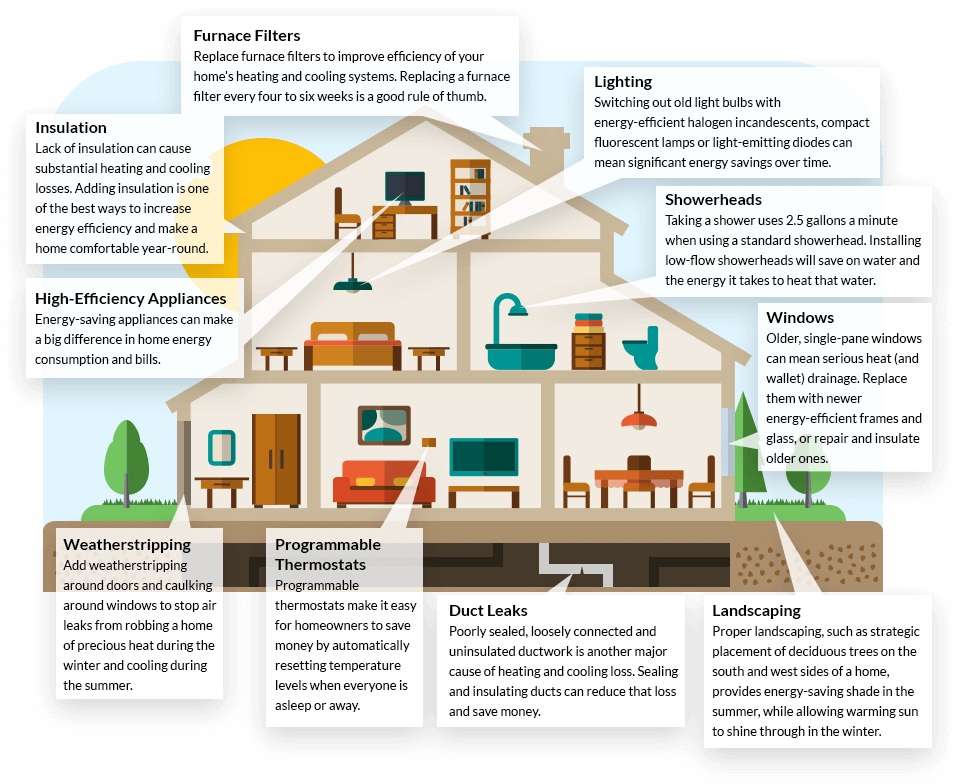

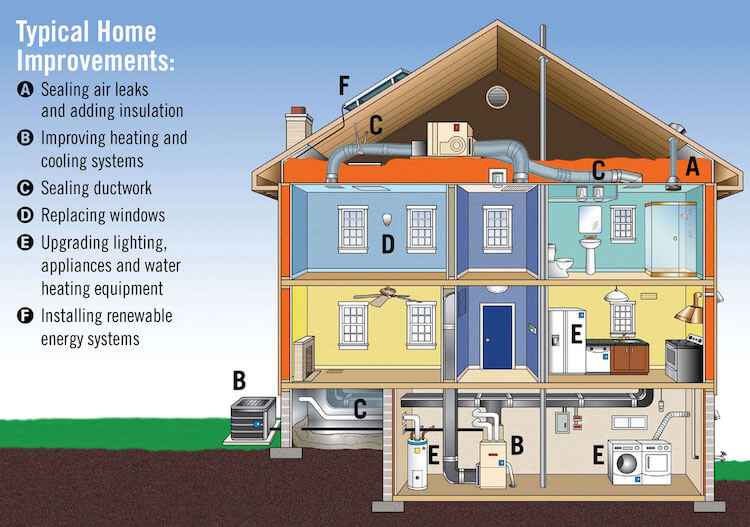

IRS Form 5695 is the essential document used to claim a credit on your tax return for the installation of solar panels on your property. It is commonly referred to as the Solar Investment Tax Credit Form. The form addresses the concept of “Residential Energy Credits,” calculating non-refundable credits for energy-efficient property improvements. Qualified improvements include residential solar panel systems, solar energy storage, fuel cells, geothermal heat pumps, and small wind turbines.

Step-by-Step Guide to Completing IRS Form 5695

- Calculate Total Solar System Cost: Add up the total expenses incurred in installing the solar power system, excluding any cash rebates or incentives. Record this value on line 1.

- Include Additional Energy-Efficient Improvements: Enter the costs of any other energy-efficient enhancements made on lines 2 to 4. These can encompass solar water heating, small wind energy generators, geothermal heat pump property costs, and more. Sum up these values for line 5.

- Calculate the Tax Credit: Determine your federal solar tax credit by multiplying the number from line 5 by the applicable percentage (usually 30%). Record this result on line 6.

- Enter the Tax Credit Value: If you aren’t claiming a tax credit for fuel cells and don’t carry over any tax credits from the previous year, place the value from line 6 on line 13.

- Evaluate Tax Liability: Assess whether your tax liability from taxable income qualifies for the full 30% tax credit within a single year.

- Calculate Maximum Claimable Tax Credit: Compute the maximum tax credit you are eligible for by following the instructions on page 4 of the form. Include other tax credits you may qualify for.

- Enter Maximum Tax Credit: Place the result from step 6 (maximum claimable tax credit) on line 14.

- Determine Smaller Value: Compare lines 13 and 14, and record the smaller value on line 15.

- Calculate Carry-Over Credit: If your tax liability from step 5 is lower than your tax credits, calculate the amount to carry over to the next year on line 16.

- Transfer Credit to Form 1040: Record the value from line 15 on line 5 of Schedule 3 on Form 1040 to claim your credit.

Concluding the Claim Process

Claiming the Solar Tax Credit with Form 5695 is a strategic move for homeowners investing in solar panels. This process entails:

- Meeting eligibility requirements for residential energy credits.

- Accurately completing Form 5695.

- Including Form 5695 with your tax return filing.

While Home Solar Simplified strives to simplify the integration of clean energy solutions into mainstream living, it’s important to note that professional advice from licensed accountants or tax experts is recommended for specific inquiries related to completing Form 5695 for the Federal Investment Tax Credit.

Feedback and Interaction

Home Solar Simplified welcomes your suggestions, feedback, and contributions to further enhance the content and accuracy of information on this topic. Should you have any comments or recommendations, or if you believe there are missing details, feel free to engage with us. Your insights contribute to enriching our knowledge base.