- December 12, 2022

- admin

- 0

Solar Investment Tax Credit (ITC)

The solar Investment Tax Credit (ITC) is one of the most important federal policy mechanisms to support the growth of solar energy in the United States. Since the ITC was enacted in 2006, the U.S. solar industry has grown by more than 200x – creating hundreds of thousands of jobs and investing billions of dollars in the U.S. economy in the process. SEIA has successfully advocated for multiple extensions of this critical tax credit, including successful passage of the Inflation Reduction Act in August 2022. SEIA also fought for successful passage of many other important tax measures in the IRA, including adding energy storage to the ITC, creating solar manufacturing tax credits, and ensuring interconnection costs are a qualified expense for solar projects under 5 MWac.

Quick facts

- The ITC is a 26 percent tax credit for individuals installing solar systems on residential property (under Section 25D of the tax code).

- The Section 48 commercial credit can be applied to both customer-sited commercial solar systems and large-scale utility solar farms. The rate is effectively at 30% until Treasury issues guidance on new wage and apprenticeship standards. Two months later, the rate will be at 6%, with an additional 24% (for a total of 30%) available for meeting these new labor standards.

- Ten percent “adder” credits are also available for section 48 projects that meet wage and apprenticeship requirements. One credit is for utilizing domestic content on projects, another is for siting in energy areas. Additionally, applicants may seek 10 or 20 percent “adders” for building in certain low-income areas. More detail on these adder credits can be found here, as well as a detailed summary for SEIA members here.

- Commercial taxpayers may now also choose a Production Tax Credit (PTC) for solar instead of an ITC. The PTC rate is 1.5 cents (adjusted for inflation, it is presently 2.6 cents). The full value of the PTC is effective until Treasury issues guidance on new wage and apprenticeship standards. Two months later, the underlying rate will be at .3 cents, with an additional 1.2 cents (for a total of 1.5 cents) available for meeting labor standards.

- The residential and commercial solar ITC has helped the U.S. solar industry grow by a factor of more than 200x since it was implemented in 2006, with an average annual growth of 33% over the last decade alone.

- Eligibility for the Section 48 ITC is based on a “commence construction” standard. The IRS issued guidance in June 2018 that explains the requirements taxpayers must meet to establish that construction of a solar facility has begun for purposes of claiming the ITC. Note that commence construction does not apply to section 25D residential solar.

- The 2022 extension of the ITC has provided market certainty for companies to develop long-term investments that drive competition and technological innovation, which in turn lowers energy costs for consumers.

- Despite progress, solar energy still only represents roughly 3% of energy production in the United States.

- Moving forward, a tax policy that continues to provide stability and investment opportunity for solar and storage energy should be a part of any national discussions about tax, infrastructure, or decarbonization.

Impact of the Solar ITC

The ITC has proven to be one of the most important federal policy mechanisms to incentivize clean energy in the United States. Solar deployment, at both the distributed and utility-scale levels, has grown rapidly across the country. The long-term stability of this federal policy has allowed businesses to continue driving down costs. The ITC is a clear policy success story – one that has resulted in a stronger and cleaner economy.

How Does the Solar Investment Tax Credit Work?

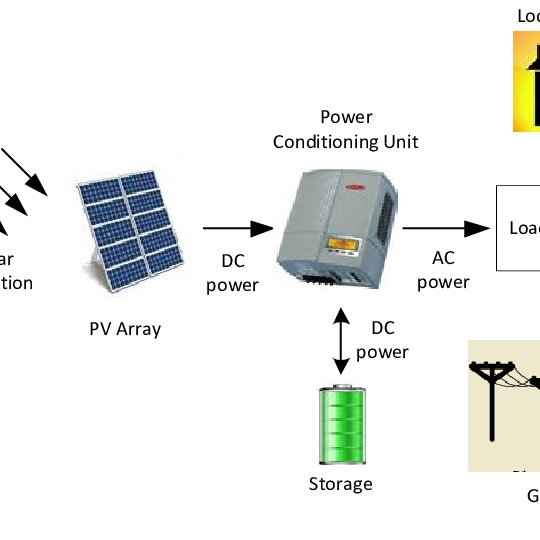

The Investment Tax Credit (ITC) is currently a 30 percent federal tax credit claimed against the tax liability of residential (under Section 25D) and commercial and utility (under Section 48) investors in solar energy property. The Section 25D residential ITC allows the homeowner to apply the credit to his/her personal income taxes. This credit is used when homeowners purchase solar systems and have them installed on their homes. In the case of the Section 48 credit, the business that installs, develops and/or finances the project claims the credit.

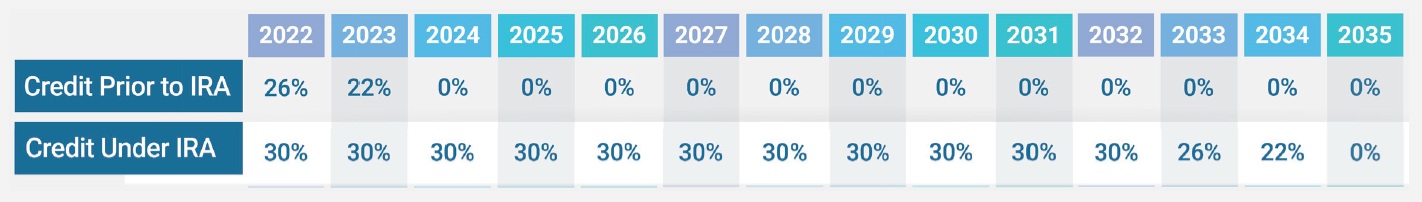

A tax credit is a dollar-for-dollar reduction in the income taxes that a person or company would otherwise pay the federal government. The ITC is based on the amount of investment in solar property. Under current law, the ITC will continue according to the following schedule:

Commercial and utility-scale projects which have commenced construction before December 31, 2023 may still qualify for the 26 or 22 percent ITC if they are placed in service before January 1, 2026. The IRS issued guidance (Notice 2018-59) on June 22, 2018 that explains the requirements that a taxpayer must meet to establish that construction of a qualified solar facility has begun for purposes of claiming the ITC.

To find out more information on the federal solar tax credit and calculate the credit amount per year based on household income, Solar-Estimate has a tax incentive calculator and additional detailed information.

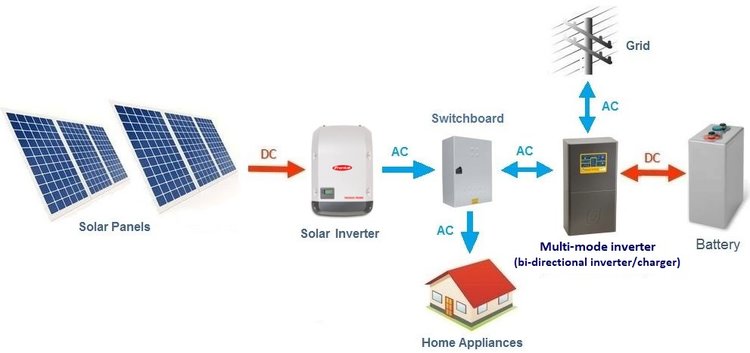

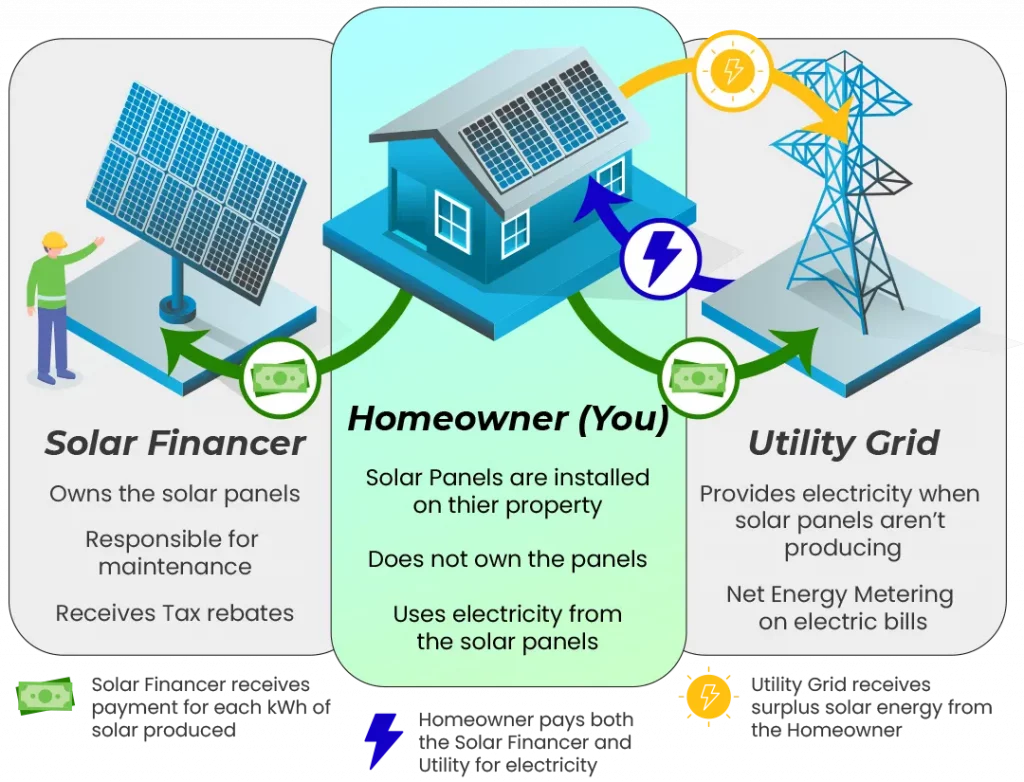

Solar on New Residential Homes

If a homeowner buys a newly built home with solar and owns the system outright, the homeowner is eligible for the ITC the year that they move into the house. If the homeowners leases the solar system or purchases electricity from the system through a power purchase agreement (PPA), then the ITC is claimed by the company that leases the system or offers the PPA.