- October 23, 2022

- admin

- 0

Even if you don’t have the cash to buy your solar panels, in most cases, I’m fully convinced that it’s not a good idea. PPA agreements are similar to leases, and I advise avoiding these, at least for residential solar systems. It would be better to take a loan to pay for the system so that you own it.

Solar systems that are owned, even if they have been financed, are really the best option if you want to make the purchase viable and get a decent return on investment (ROI).

Here are 16 important reasons why you definitely shouldn’t lease solar panels. Consider them all carefully before you make a decision to lease solar panels.

- You Won’t Own the Solar Panels.

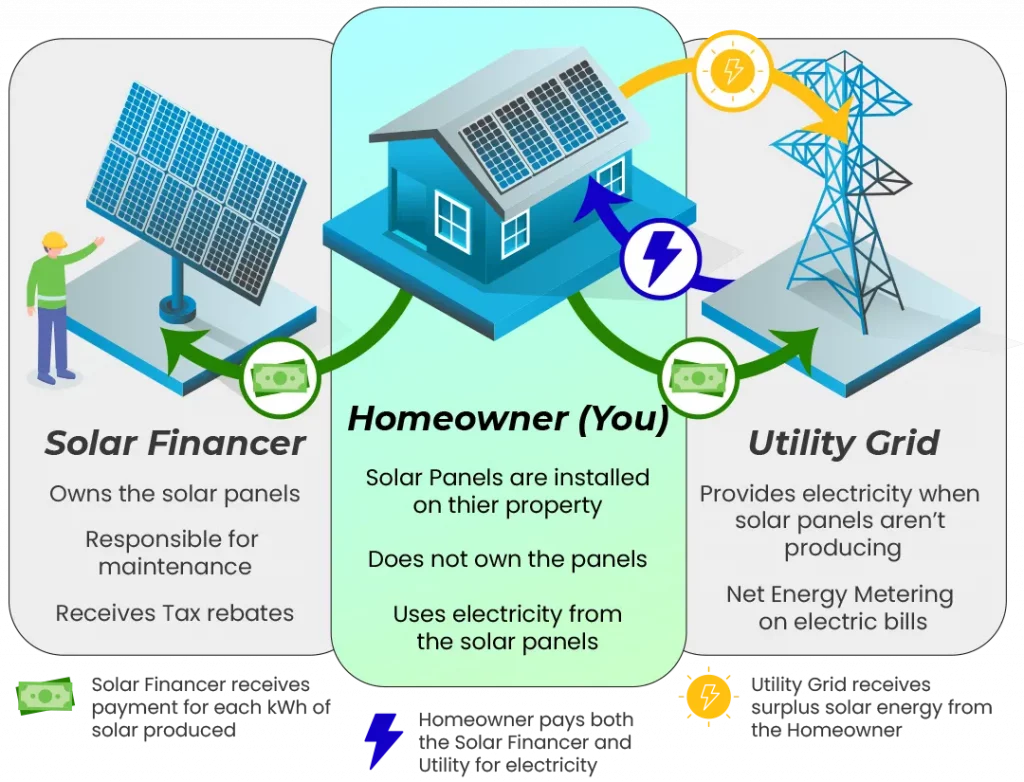

The solar system is owned by a third-party developer, not you. If you lease the system or have a PPA, SRECs are normally owned by a third-party developer.

Furthermore, because you don’t own the panels, you don’t have control over them. You also won’t get the added benefits from various financial credits (see 2 and 3 below).

As I’ve gone to purchase homes both for myself and for the company to do our net-zero home renovations on, I sometimes run into properties with descriptions like this:

A beautiful small home is nestled in the heart of XYZ city. Price is $220,000 with solar panels, $180,000 if you pay off the solar system.

Now, in the madness of the real estate market and trying to find a home in general, you must figure this one out. What it means is that the sellers had signed a solar lease, and they cannot sell the house without paying off the system contract price to the solar company that owns this lease.

The realtor, in this case, had told me that the previous couple had made an emotional decision and signed, but now there was a lien on the house and the system must be paid off by $40,000 before they can sell.

Since we design solar systems here and after looking at the roof, I knew the system only cost the installer a max of $15,000 or so, given the number of panels and overall KW size.

This isn’t to scare you off immediately here, but these are real stories. Be careful of what you’re signing up for and read these contracts fully, and probably multiple times over.

- You Won’t Have Access to Solar Renewable Energy Credits.

SRECs show how much energy is produced using solar power. Although not available in all U.S. states, where they are available, homeowners can earn one SREC for every 1000 kilowatt hours they produce using their solar panel system.

Many cities, counties, and states, also waive property taxes on solar, along with the sales tax to purchase the system, along with other potential benefits. It just depends on where you live and you’ll have to research your local situation.

- Leased Solar Panels Do Not Add Value to Your Property.

Leased solar panels are excluded from property appraisals. This means that they are not an asset, which, in turn, means that if you lease your solar panels, they won’t help you earn more money for the sale of your home.

- You Have to Pay for the Energy You Generate.

Because you don’t own your solar panels, you will have to pay a monthly fee to use the energy that your solar panels generate. If you owned the system, this energy could be 100 percent free, as it is in my sustainable, net-zero home.

- A Lease Is Personal Property and Not Real Estate.

A lease is a personal property contract and doesn’t apply to the home, which is regarded as real property. So, if you sell your home and don’t want to take the solar panels with you, you will have to persuade the buyer to take over your contract.

While some buyers are willing to take over solar leases, there is no way of knowing in advance. Also, buyers will need to apply for credit before they take over a solar lease.

These factors can make a house more difficult to sell and might prolong the process.

- A Solar Lease Can Make It Difficult to Sell Your Home.

Solar leases are seen as an obstacle by many real estate agents selling solar homes. We discovered that solar homes can sell 20 percent to more than 100 percent faster than those without solar. But if there’s a solar lease in place, they tend to sell more slowly. This is primarily because they complicate the selling process.

buyers to take over solar lease agreements isn’t easy and warns that buying out leases can be very costly.

Another Quick Story About Solar Leases

On the first net-zero renovation project we finished, I went after the low rates and refinanced at the time. This involved having the lender hiring and scheduling a new appraisal of the property.

Literally the first question the appraiser asked me was:

“Do you lease or own the solar system?”

Why did he ask me this? When asked why that was his first question, he said that leased systems cause so many complications on home value and resale value that it actually decreased the value of the home in the local market.

When he found out that I owned it there was a visible big sigh of relief on his end, because he really liked the project and the whole net-zero project. He then told me a leased solar system had the potential to ruin the whole concept.

- It Isn’t Easy to Move Solar Panel Systems.

It isn’t that easy, and may not even be possible, to relocate solar panels from one house to another. If it is feasible, you will also have to cover the costs, which might mean it isn’t a financially viable option. Also, solar systems are designed for specific properties, so the design might not work for a different house.

Viability will depend on the condition of the new roof and other physical and environmental factors. You will also need approval from your local authority, and/or local government commission, utility company, and possibly a homeowners’ association.

- You Will Be Locked into Monthly Repayments for Many Years.

Lease agreements are usually 10 to 25-year agreements. This means that you will be contractually bound to pay the leasing company regular payments for the duration of the lease.

To get out of a solar lease you can opt for a buyout of the agreement, buy the solar system at market value, relocate the panels, or transfer the lease to the new homeowner.

Some lease agreements do include a buyout period in the contract, but usually only once the lease has run for at least five to seven years.

- Most Lease Agreements Have Restrictions.

It is common for leases to restrict certain activities or developments the property owner might want to carry out. For example, lessees may not be allowed to replace the roof or build any structure on the property that might cast shadows on the system.

Also, the leasing company will need access to your roof to be able to maintain the solar panels for the duration of the lease. This may not always be convenient for you, the homeowner.

According to Choose Energy, another factor is that leasing companies tend to design solar systems to fit their specifications rather than being guided by the number of panels homeowners want or where they want them to be placed.

When you buy the system outright, you have considerably more freedom determining the size of the system and how it is installed.

- Site Upgrades May Be Needed.

Sometimes third-party developers require property owners to do upgrades to ensure that their solar PV system maintains their efficiency. If trees grow and shade the panels on the roof, they might insist that they are trimmed or even removed.

Their motivation would usually be to ensure maximum energy is produced so that they can earn more SERCs. But it’s going to cost you money, and you will have to comply when they make the demands.

While upgrades may well be beneficial for the property, they may not be quite what you were planning or what you would otherwise prioritize.

- Transfer of Ownership Is Often Problematic.

In point 10, we said you have four options if you want to get out of a solar lease. When homeowners sell, transferring the lease into the name of the purchaser usually seems to be an obvious solution. But it is far from simple and can be seriously problematic.

A solar contract requires the new owner to take over the lease and the terms previously agreed on with the leasing company. Often, new owners would rather own solar equipment, especially if the system was installed 10, 15, or more years before. Solar technology is changing all the time and old equipment might be obsolete.

If this happens, you will be liable for the rest of the lease term and any fees associated with removing and/or relocating the equipment.

If the purchaser does agree to transfer the solar lease into his or her name, because solar systems are owned by a third party, the lessor will have to assist with the transaction. This might seem like an advantage, but it can be the cause of delays.

- You May Be Forced to Drop the Selling Price to Pay for the Lease.

If you can’t get the person who wants to buy your home to take over the lease, you could reduce the selling price of the house to cover the amount they will have to pay until the lease terminates. That’s assuming you don’t want to take it with you to your new home or buy the equipment, and you can’t afford a buy-out.

If the lease still has a way to run, the price reduction could be substantial, impacting your ROI negatively.

Another option could be to continue paying the lease while the new owner gets the benefit of the solar equipment. And that is not an option anyone is going to like unless the lease is nearing the end of its term. Even so, it doesn’t make financial sense.

- A Lease Reduces Your Potential Return on Investment.

Buying a solar PV solar system for your house is undoubtedly an investment, and one that will reap dividends for decades to come. But you must do it right to avoid anything that will eat into the money you are going to save by going solar.

An important point to remember is that lease payments generally increase by a certain percentage every year. The longer the lease, the higher the payment will go.

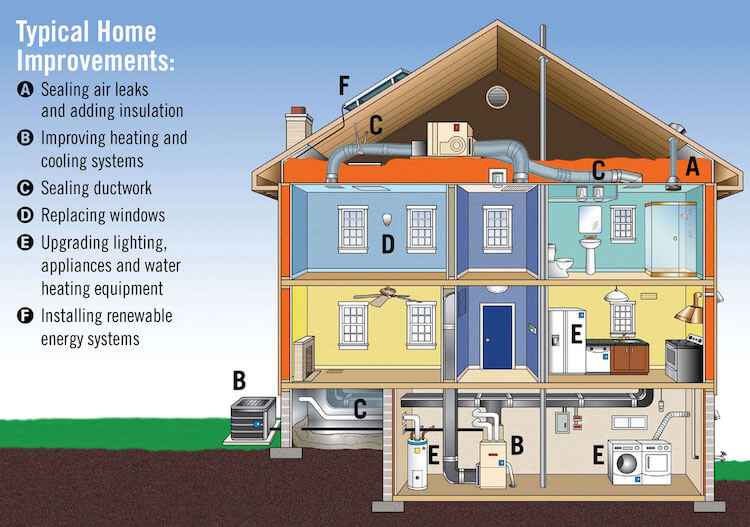

When I set out to prove that it was possible to renovate a house and make it a sustainable net-zero home on an affordable budget, I set very specific goals. One of them was to power the whole house with efficient, renewable, solar energy without the costs impacting the project negatively.

If I had opted to lease my solar system, I know that this would have reduced my ROI. As it is, I’m on target and very happy with its potential. I have absolutely no doubt that owning your solar system will result in the best possible savings, which translates directly to ROI.

- Quality Maintenance Isn’t Guaranteed.

Free maintenance is usually included for leased solar panels, but the standard of service doesn’t always live up to consumer expectations.

John McDonnell, the founder of Watthub, which is an online platform that lists solar professionals, warns that many solar systems don’t get the maintenance required. But homeowners have to keep paying the lease payment every month–even if they don’t get the full service.

In any case, opting for a solar lease just to get free maintenance doesn’t make any sense at all. If this is important to you, shop around and instead find a solar company that offers a maintenance service on purchased systems.

Conclusion

In the article Does Solar Really Add Value To Your Home, we took a deep dive into multiple research studies that have explored this topic. Our conclusion was that solar definitely increases the value of homes. The only nebulous factor was how much because things like type, size, and age of the system all impact value.

In this article, we show that if you lease your solar panels, you will not add value to your house. This is primarily because you don’t own the solar system, a third party does. You need to own the system to add value to your property.

There’s a lot to consider here, but ultimately, the only time to even think about leasing solar panels is when you don’t have the available cash to pay upfront and don’t qualify for a loan. In this situation, a solar lease entices many unsuspecting consumers who are determined to embrace the benefits of solar power.

My mission is to ensure that you recognize the potential complications and disadvantages solar leases entail. If you have an income, pay taxes, and have some cash or a good credit rating, you can buy or finance solar panels for your home.