Since 2006, the Solar Investment Tax Credit has offered tax reduction incentives for homeowners who choose to “go solar.” On August 16, 2022, embracing residential solar energy became even more enticing when the Federal Government signed the Inflation Reduction Act of 2022 into law.

Among numerous climate-conscious consumer and industry incentives, the most impactful is the increase, expansion and extension of the Residential Clean Energy Credit—also known as the Solar Investment Tax Credit (ITC).

The ITC effectively raises the amount of credit you can apply against your income tax burden from 26% to 30%. Instead of decreasing next year as scheduled, it’s been extended until 2032 before it reduces again. The tax credit is also retroactive to solar energy systems installed during the 2022 tax year. Here’s what you need to know about the ITC and how to make it work for you.

What Is the Solar Tax Credit?

The Solar Tax Credit reduces your income tax in exchange for going solar. The ITC allows homeowners and business owners who have purchased and installed solar photovoltaic (PV) energy generation systems in 2022 or will do so before 2033 to claim a federal tax credit equal to 30% of the overall cost of the system’s components, installation and associated fees during the year of installation.

A tax credit is a one-for-one dollar amount reduction from income tax that you would have paid without the credit. If your solar PV system costs $20,000 and you claim the ITC at 30%, you will owe $6,000 less in income tax for the year, effectively lowering the system’s total cost to $14,000.

As the new law currently stands, if the amount of tax you owe for the year you become eligible is less than the credited amount, you can roll the difference over to the following year. The ITC will lower to 26% in 2033 and again to 22% in 2034. The credit will be eliminated at the end of that year if it doesn’t receive another extension.

How Do I Claim the Solar Tax Credit?

If you meet the eligibility requirements to receive the Solar Tax Credit, you’ll need to complete and include Form 5695 with your federal tax return for the tax period in which the PV system is first installed and made operational.

Eligibility for the Solar Tax Credit

You could be eligible to receive the ITC on your federal tax return if the following statements are true. Consult your tax accountant to ensure your eligibility and for exception information.

- The PV system is an original, new installation or is operational for the first time.

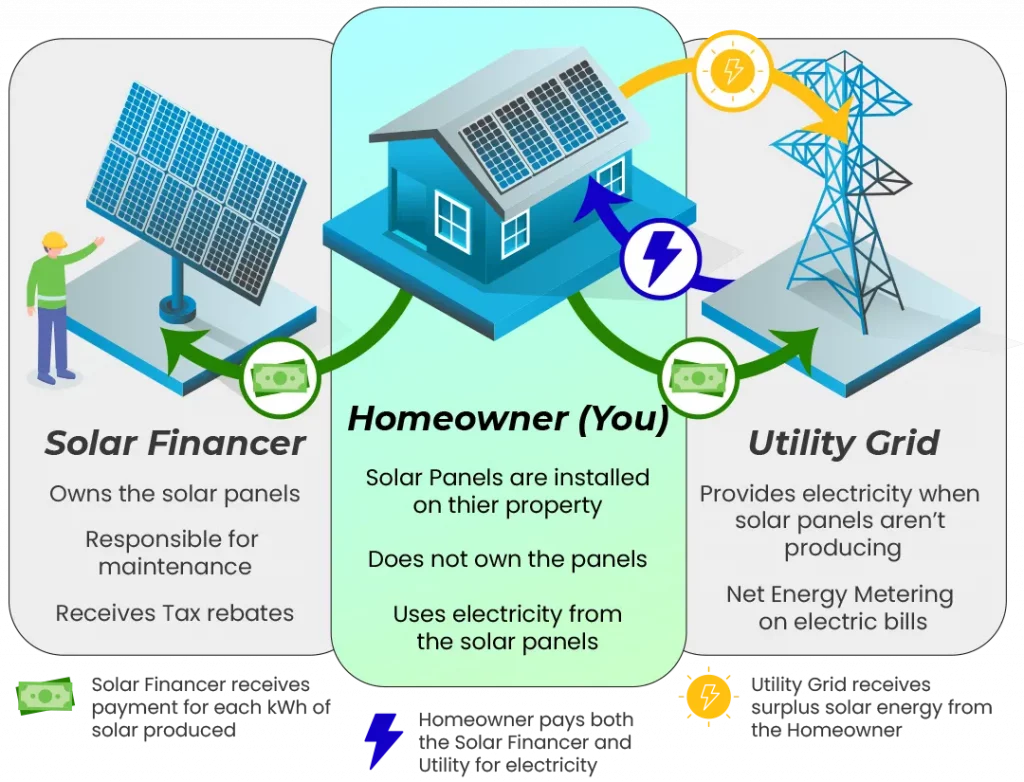

- You own the system outright or have financed the parts and installation with a loan.

- You aren’t leasing the system or paying anyone for the energy created by the system.

- You’re claiming the credit based on the cost of the PV system, its components, installation and fees. Items and appliances that operate on the created energy aren’t included in this tax credit.

What Expenses Are Included?

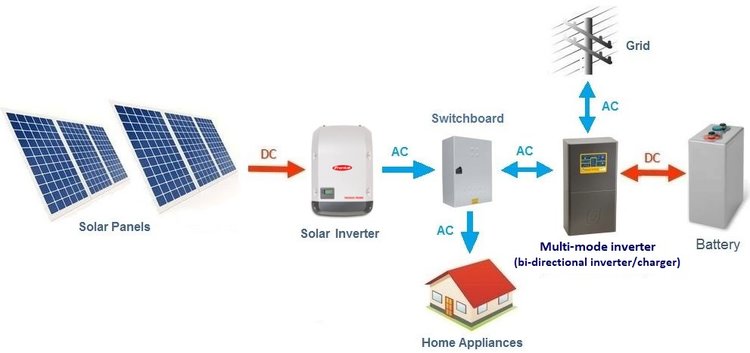

The new law expands the list of expenses covered by the tax credit to include energy storage components, including standalone devices, with a rated capacity of three-kilowatt hours or more.

Other covered expenses continue to include the cost of the solar panels and their components, sales tax, permits and other fees, essential wiring, inverter systems, hardware, site prep and installation charges.

The Inflation Reduction Act Solar Tax Credit Step-Down Schedule

Although the ITC will be around for at least the next decade, it will begin to phase out in 2033. At that time, the credit amount steps down to 26%. In 2034 it will be further reduced to 22% and eliminated for the tax year 2035.

When Should I Go Solar?

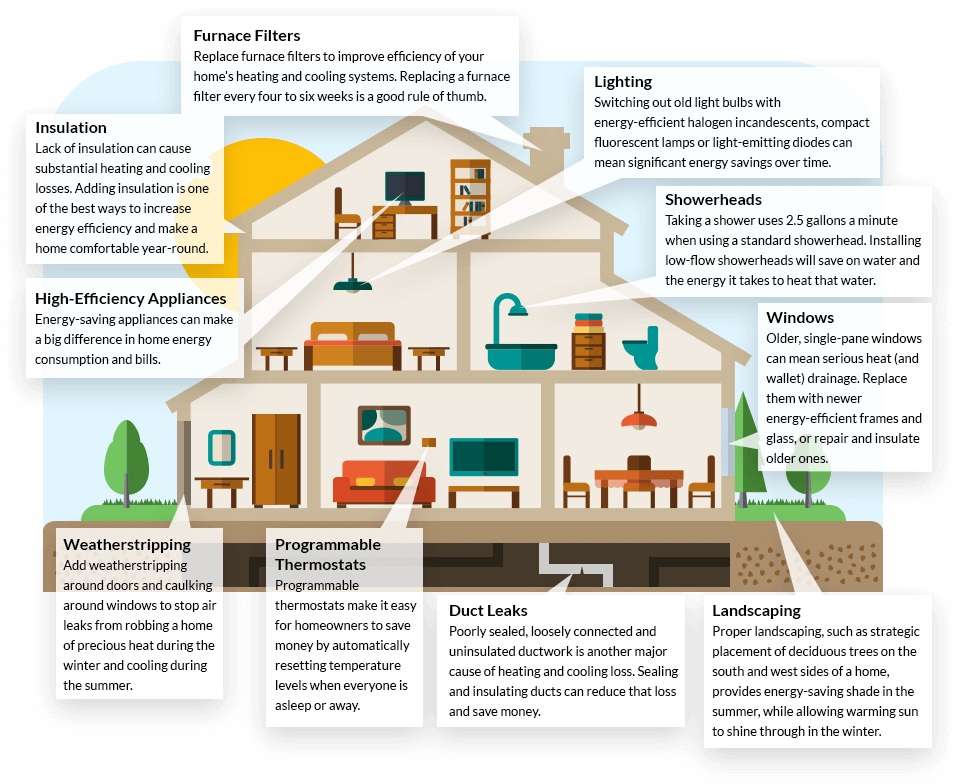

The new law is currently in effect and will be in some capacity until the end of 2034. From nearly every angle, going solar now is more appealing than ever. So, is now the time to leap, or should you wait for an even better deal? The answer may not be as cut-and-dried as it appears. There are several factors to consider when deciding if a solar PV system is worth it to you now, later or never.

- Solar energy technology is better, less expensive and more efficient than ever.

- Even with federal and state tax credits and utility company rebates, the average system still takes six to 10 years to pay for itself through lower energy costs.

- The tax credit reduces the amount of income tax you’ll owe. It’s not an immediate discount on products and installation. You’re still responsible for the upfront cost of the system.

- Several states offer some form of net metering that essentially pays you for creating more energy than you use with a PV system. These programs are being contested in some areas and may not last indefinitely.

- Other components of the same law offer incentives to industries and manufacturers of solar and related products. The effect these incentives will have on overall pricing over the next several years is yet to be determined.

- Other solar energy options, such as purchasing an interest in an off-site solar project also include tax credit benefits and could be another choice beyond installing your own system.