- December 16, 2022

- admin

- 0

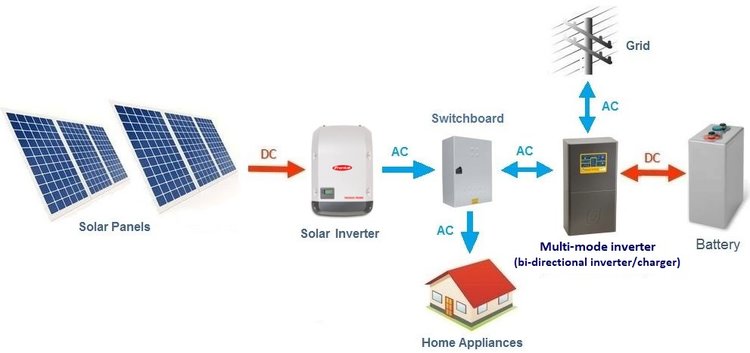

Consider solar panels for your home if you have a high utility bill, live in a prime location, and qualify for tax breaks or other savings.

The rising cost of electricity from traditional sources and government incentives to go green make the idea of installing solar panels more attractive for many homeowners.

But the true cost of solar panels, and whether they’ll help you save money, depends on a few key factors.

Minimal long-term costs can make up for the upfront costs. “Most systems don’t require much maintenance and are designed to last for 20 years or more with little change to the amount of electricity produced,” Nilsen says.

When calculating the total price, consider how much energy you regularly consume — your usage is listed on your monthly utility bill — and what size system will generate the amount needed. Some tools, like the Solar Reviews calculator, estimate the system size for you.

With installation, an average residential 5-kW system costs from $3 to $5 per watt, according to the CSE, which results in the $15,000 to $25,000 range. That cost is before any tax credits or incentives.

If you know your current energy usage, you can calculate how much you’ll need to pay for solar panels.

Then comparison shop for solar panels as you would other big-ticket items, such as a car or TV. Some companies reduce installation costs through rebates and other programs.

Aggarwal recommends getting quotes from three to five contractors.

Take advantage of government incentives

A federal law passed in 2022 incentivizes consumers to make clean energy enhancements, like installing rooftop solar. A substantial update to an existing energy-related tax break that was set to expire at the end of 2023, the Residential Clean Energy Credit allows taxpayers who have solar (and other approved clean energy equipment) installed to recoup 30% of the cost in the form of a federal tax credit.

What that means: A solar setup that costs $15,000 would yield a $3,900 credit (26% of $15,000) that you can take advantage of come tax time to reduce any federal taxes owed. The credit isn’t refundable though, meaning any money left over after your full tax bill is covered won’t be paid out to you. But you may be able to apply the remainder of the credit toward taxes owed in subsequent tax years.

The credit applies to eligible equipment installed after Dec. 31, 2021, and remains in effect at the 26% rate through 2032. It decreases incrementally after that.

How much do solar panels cost for homes?

On average, solar panel installation and the system together can run from $15,000 to $25,000, according to the latest information from the Center for Sustainable Energy.

Electricity rates vary by location. The national average is about 15 cents per kilowatt-hour, according to year-to-date 2022 data from the U.S. Energy Information Administration.

Before you make the leap, learn how your electric bill, location and incentives can impact your wallet over time. Here are five steps to take to determine whether you’ll save more than you spend on solar panels.

- Review your electric bill

Solar panels generate their own power and can therefore greatly offset your monthly electricity bill, if not eliminate it. The higher your bill, the more likely you’ll benefit from switching. But be aware that electricity rates and usage — the main charges on your statement — are volatile.

“If a utility’s electricity prices fluctuate, so could the amount of savings,” says Garrett Nilsen, deputy director for the U.S. Department of Energy’s solar energy technologies office. “Similarly, if energy consumption changes, the amount of savings can also vary.”

Visit the EIA website to view the most recent prices per state.

- Evaluate your sunlight exposure

More sun means more energy produced and a greater potential to save with solar. Certain states, like Arizona and California, average more sunlight hours per day.

Your home’s orientation toward the sun, the amount of shade it gets, and its roof type also affect a solar system’s output. You can estimate the efficiency of panels on your home using the SolarReviews calculator.

- Estimate and compare the cost of solar panels for homes

The brunt of the expense with solar panels is in installation and the purchase of the actual panels.

Minimal long-term costs can make up for the upfront costs. “Most systems don’t require much maintenance and are designed to last for 20 years or more with little change to the amount of electricity produced,” Nilsen says.

When calculating the total price, consider how much energy you regularly consume — your usage is listed on your monthly utility bill — and what size system will generate the amount needed. Some tools, like the Solar Reviews calculator, estimate the system size for you.

With installation, an average residential 5-kW system costs from $3 to $5 per watt, according to the CSE, which results in the $15,000 to $25,000 range. That cost is before any tax credits or incentives.

If you know your current energy usage, you can calculate how much you’ll need to pay for solar panels.

Then compare shops for solar panels as you would other big-ticket items, such as a car or TV. Some companies reduce installation costs through rebates and other programs.

Aggarwal recommends getting quotes from three to five contractors.

4. Take advantage of government incentives

A federal law passed in 2022 incentivizes consumers to make clean energy enhancements, like installing rooftop solar. A substantial update to an existing energy-related tax break that was set to expire at the end of 2023, the Residential Clean Energy Credit allows taxpayers who have solar (and other approved clean energy equipment) installed to recoup 30% of the cost in the form of a federal tax credit.

What that means: A solar setup that costs $15,000 would yield a $3,900 credit (26% of $15,000) that you can take advantage of come tax time to reduce any federal taxes owed. The credit isn’t refundable though, meaning any money left over after your full tax bill is covered won’t be paid out to you. But you may be able to apply the remainder of the credit toward taxes owed in subsequent tax years.

The credit applies to eligible equipment installed after Dec. 31, 2021, and remains in effect at the 26% rate through 2032. It decreases incrementally after that.

Depending on your state, you may receive extra incentives like cash back, property tax exemption, waived fees and expedited permits. In some states, homeowners with solar panels can sell excess power to their local utility companies. Look up credits available in your state by reviewing the database of state incentives for renewables and efficiency.

- Keep an eye on trade policy

Changes in government trade policy also impact prices. There have been varying tariffs on imported solar cells and panels over the last decade affecting costs and supply. For example, tariffs resulted in a 16-cent-per-watt increase for the average consumer in 2018, which translated to an overall increase of $960 for a 6-kW system, according to Solar News

President Biden placed a two-year pause on new tariffs in June 2022.

Is solar panel installation right for your home?

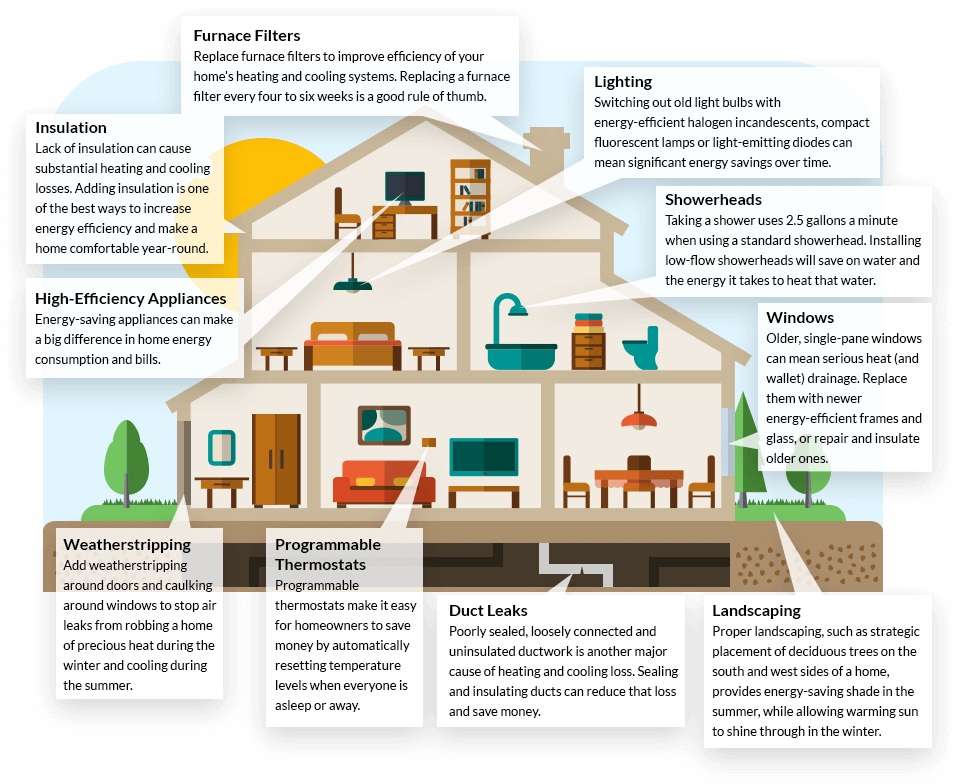

If you live in an area with high energy rates and a suitable solar rating, and if you can afford the initial investment, it’s worth installing solar panels on your home while the 26% tax break is in place — for the good of the environment and your wallet. But don’t expect to eliminate your power bill overnight.

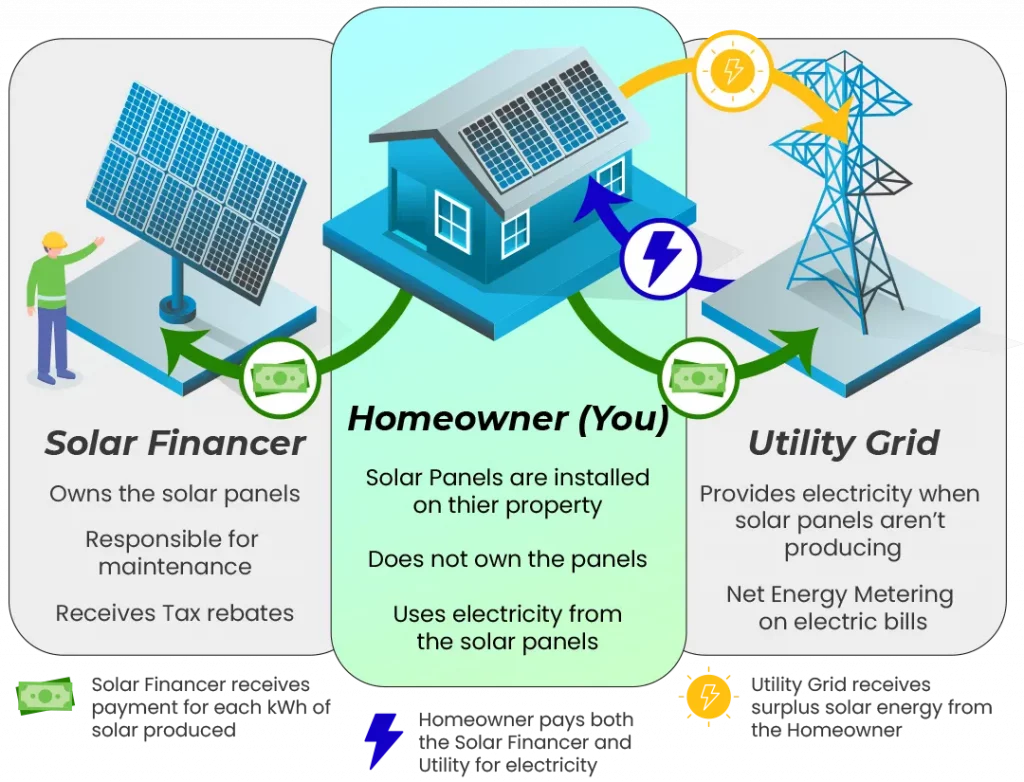

If you decide to purchase solar panels, shop around and search for incentives. Consider financing with a solar loan if you’d rather spread out the cost over time. Keep in mind that you don’t have to buy solar panels — you can lease them, too. Leasing offers a lower upfront cost, though since you don’t own the panels, they won’t raise the value of your home, and you may not be eligible for incentives.

Going solar isn’t the only potential way to save money. Learn more about what you can do to lower your bills.

Spot your saving opportunities

See your spending breakdown to show your top spending trends and where you can cut back.

About the authors: Lauren Schwahn covers consumer credit and debt at NerdWallet. Her work has been featured by USA Today and The Associated Press. Read more

Tommy Tindall is a personal finance writer at NerdWallet. He covers savvy spending and ways to plan for a prosperous financial future. Read more