- January 19, 2023

- admin

- 0

California’s Remarkable Solar Incentives Revolutionize State’s Energy Landscape

Under the sun-drenched skies of California, the impact of solar incentives has been nothing short of remarkable. With its year-round sunny climate, the state has harnessed the power of solar energy through six distinct incentive programs, propelling California to the forefront of solar power generation in the United States.

1. Federal Solar Energy Tax Credit

Every Californian resident, like any other U.S. citizen, can take advantage of the enticing 30% federal solar tax credit. An extensive guide on claiming the Solar Tax Credit for 2023 is available for reference.

2. Empowering Self-Generation through California’s SGIP

The Self-Generation Incentive Program (SGIP) in California offers financial incentives to those integrating battery storage into their energy systems. The SGIP rebate exclusively supports solar storage solutions, providing a substantial 15-20% rebate on average battery costs. Remarkably, individuals within Medical Baseline communities in Tier 2 or Tier 3 High Fire Threat Districts can even achieve full cost offset. The Medical Baseline Program extends assistance to residential customers reliant on power for specific medical needs.

3. Property Tax Exemptions Fuel Solar Energy Adoption

A compelling property tax exemption entices individuals in California to embrace solar energy. This exemption applies when purchasing, selling, constructing a new dwelling, or undergoing significant home renovations within the state. As per Section 73 of the revenue and taxation code, solar installations are eligible for property tax exclusion, extending this favorable provision until January 1, 2025.

4. PACE: Facilitating Clean Energy Financing

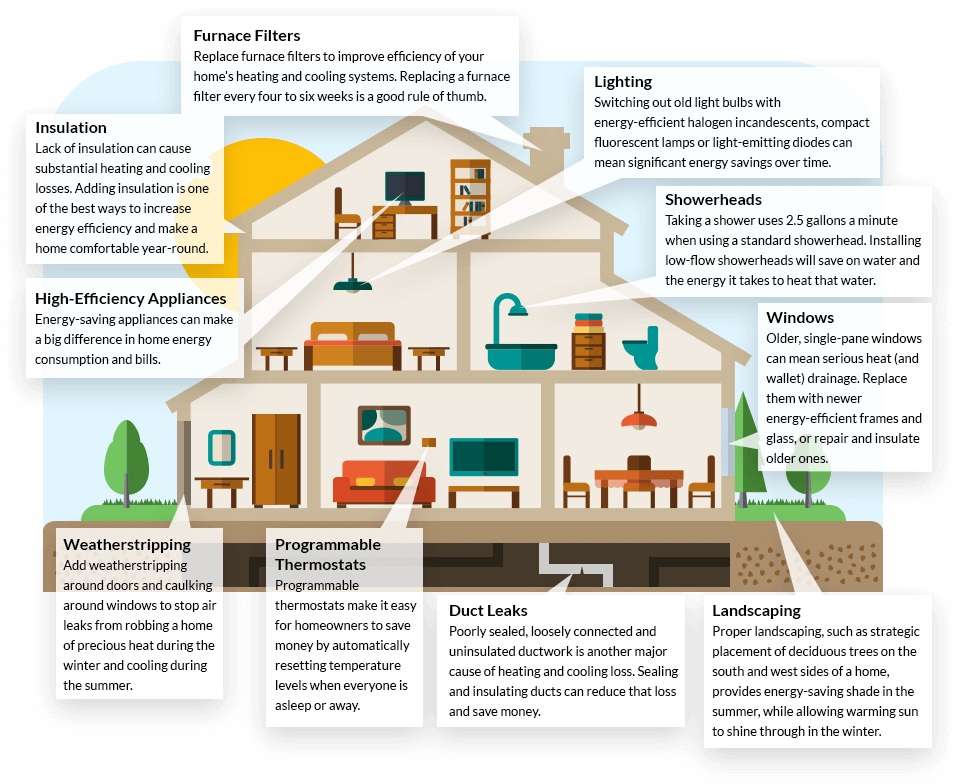

The Property-Assessed Clean Energy (PACE) program, operational in twenty states including California, streamlines financing for solar energy and energy efficiency projects. Through PACE, local authorities collaborate with property owners, providing an accessible loan option. Homeowners subsequently repay the local authority via an extended property tax bill spanning approximately two decades.

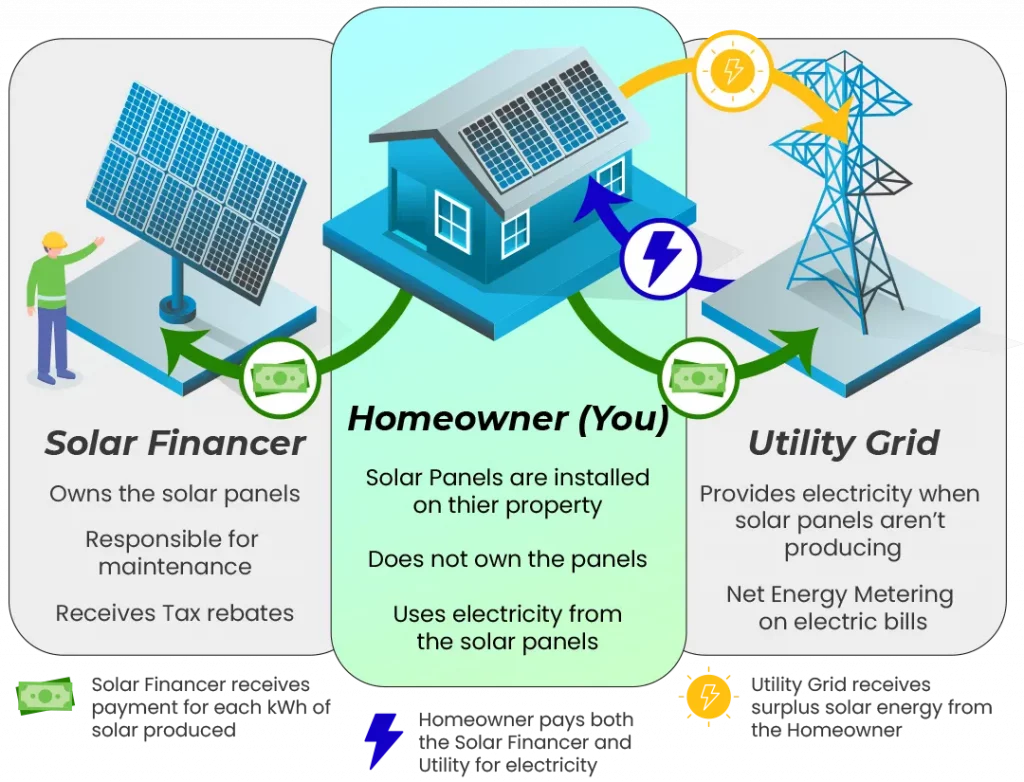

5. Empowerment through Net Metering Credit Incentives

The principle of net metering, or Net Energy Metering (NEM), empowers California homeowners to benefit from surplus electricity generated by their solar panels. This entails compensation for the discrepancy between the solar system’s energy production and the home’s energy consumption. Net metering is accessible through California’s prominent investor-owned utility companies, namely Pacific Gas & Electric (PG&E), Southern California Edison (SCE), and San Diego Gas & Electric (SDG&E), until April 14th, 2023, for new customers.

6. DAC-SASH: Advancing Disadvantaged Communities

The Disadvantaged Communities Single-Family Affordable Solar Homes (DAC-SASH) Program addresses solar accessibility for qualified residents. Under this program, eligible homeowners receive an incentive of $3 per watt to alleviate the cost of solar energy systems. Notably, those who install solar panels or related solar-powered devices on their property are exempt from property tax for the given year. To qualify for this incentive, participants must fulfill specific criteria:

- Own and reside in their home.

- Receive electrical service from Pacific Gas & Electric (PG&E), Southern California Edison (SCE), or San Diego Gas & Electric (SDG&E).

- Be enrolled in or eligible for CARE or FERA income-qualified utility bill programs.

- The property must be located in a qualified Disadvantaged Community (DAC) area.

The culmination of these incentives has established California as a beacon of solar energy adoption, setting an inspiring example for sustainable energy practices.